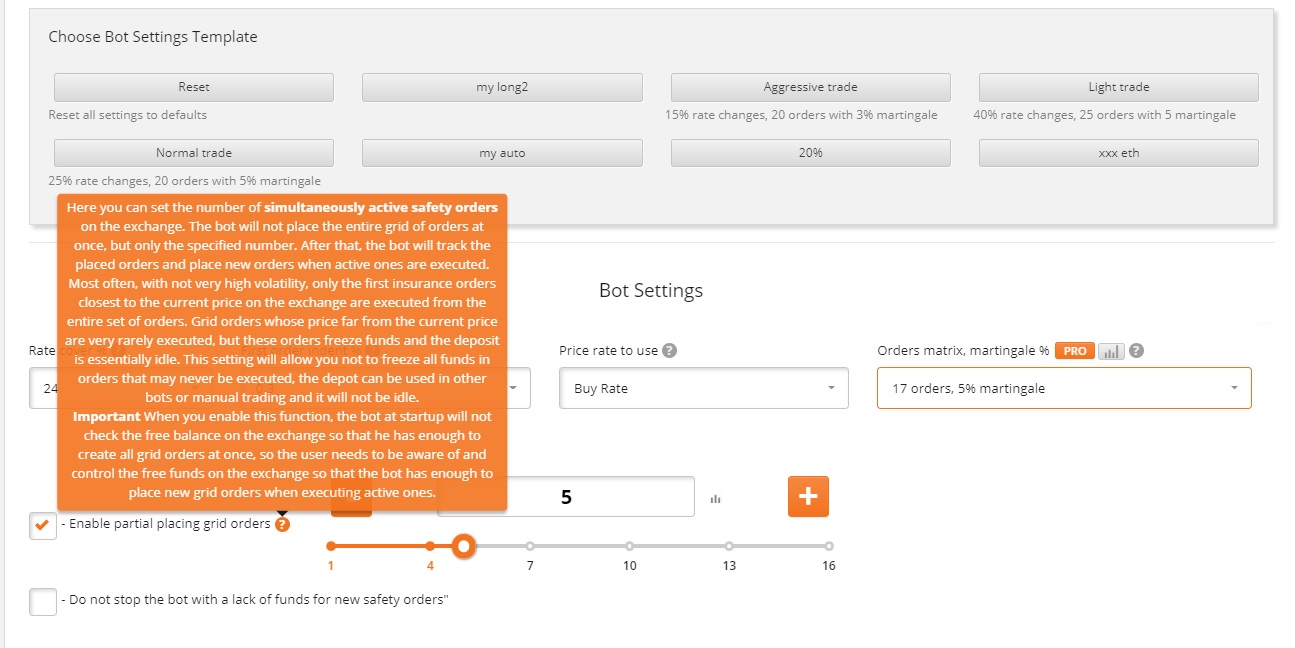

You can set the number of simultaneously active insurance orders on the exchange in the bot settings . The bot will not place the entire grid of orders at once, but only the number specified in the settings. After that, tracking the placed orders, the bot will place new orders when active ones are executed. When can this be useful?

1. It can be useful in case of low volatility.

Most often, when the volatility is not very high, only the first safety orders that are closest to the current price on the exchange are executed out of the entire grid of orders placed. Orders in the grid that are far from the current price are executed very rarely, but these orders freeze funds, and the deposit is essentially idle. This setting allows you not to freeze all funds in orders that may never be executed. Accordingly, the depot can be used in other bots, and it will not be idle.

2. If you trade Futures on Binance.

Binance Futures has introduced strict limits on the allowed price of an order placed using the API. Namely, at the moment, it is impossible to place orders above or below 15% of the current coin price. These new limits were introduced by the exchange on 23.06.2020. Before that, it was possible to place orders with a price no higher/lower than 30% of the current one, which was more or less acceptable, but this still imposed restrictions on one of the main bot settings (overlap of price changes %), which could not be set more than 30%. You can now set a considerable overlap of price changes (more than 30%), which will reduce the risks when trading futures.