May 2025 was a pivotal month for the crypto market, marked by sharp price movements, major political statements, and technological innovations.

Bitcoin Breaks Above $100,000 Again: Market Anticipates New Rally

On May 8, 2025, Bitcoin surpassed the psychological $100,000 mark for the third time in its history, reaching a local high of $104,145. This surge has become a significant signal for the crypto market: the upward trend is gaining momentum, and investor and trader interest continues to grow.

Continue reading “Bitcoin Breaks Above $100,000 Again: Market Anticipates New Rally”

April 2025 Recap: Key Events in the Crypto World

April 2025 was a dynamic month for the cryptocurrency market. From major upgrades to high-profile hacks, let’s break down the most important events that shaped the industry.

Continue reading “April 2025 Recap: Key Events in the Crypto World”

Bitcoin vs Gold: Which Will Be the Ultimate Safe-Haven Asset in 2025?

In times of global economic instability, investors are once again seeking a reliable store of value for their capital. For decades, gold has held the title of the ultimate safe-haven asset. However, in recent years, Bitcoin has emerged as a digital alternative to the precious metal. As we step into 2025, the competition between these two assets is intensifying.

Continue reading “Bitcoin vs Gold: Which Will Be the Ultimate Safe-Haven Asset in 2025?”

Crypto Swings: How Trump’s Trade War Impacts the Market

The world of cryptocurrency has always been dynamic, but recent events have added even more volatility. The trade war initiated by Donald Trump has become a catalyst for global economic changes that directly affected the crypto market.

Continue reading “Crypto Swings: How Trump’s Trade War Impacts the Market”

Major Events in the World of the Crypto Industry in February

February was a month of changes and tense moments in the crypto world. Despite the market downturn, investors’ attention was drawn to bold statements from prominent figures, shifts in the dynamics of major cryptocurrencies, and regulatory decisions.

Continue reading “Major Events in the World of the Crypto Industry in February”

Updates on the RevenueBot Platform | January

In January 2025, the RevenueBot platform introduced numerous useful updates. Let’s take a closer look at the changes.

Continue reading “Updates on the RevenueBot Platform | January”

RevenueBot: Year in Review

The year 2024 was a significant milestone in the development of RevenueBot. We focused on enhancing functionality, ease of use, and improving the reliability of our bots. The new updates make the platform even more effective and convenient for traders of all levels.

Continue reading “RevenueBot: Year in Review”

Bitcoin Outlook: The Worst Week Since FTX

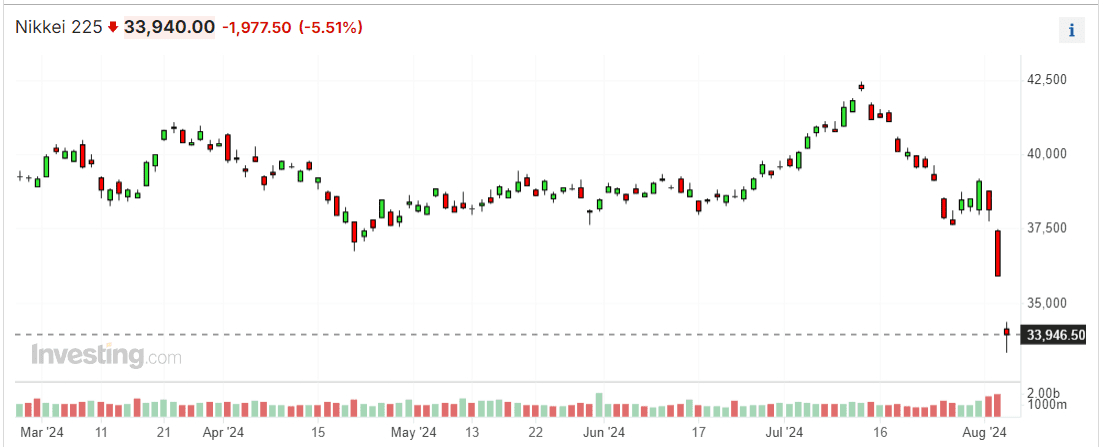

Friday brought unfavorable data from the US: non-farm employment in July was almost halved to 114,000, manufacturing orders fell by 3.3%, and the unemployment rate increased from 4.1% to 4.3%. These figures were significantly worse than forecasted, indicating a possible onset of a recession in the world’s largest economy.

Financial markets worldwide reacted negatively to the emerging risks. The Japanese Nikkei index was particularly hard hit, also pressured by the first key interest rate hike since 2006, to 0.25%. It fell by 11.1% over the week.

Investor risk aversion did not go unnoticed for BTC either: its weekly drop was 13.2%, the worst since the collapse of the FTX cryptocurrency exchange in November 2022. The decline continued on Monday, with the maximum drawdown from the record high reaching 30%.

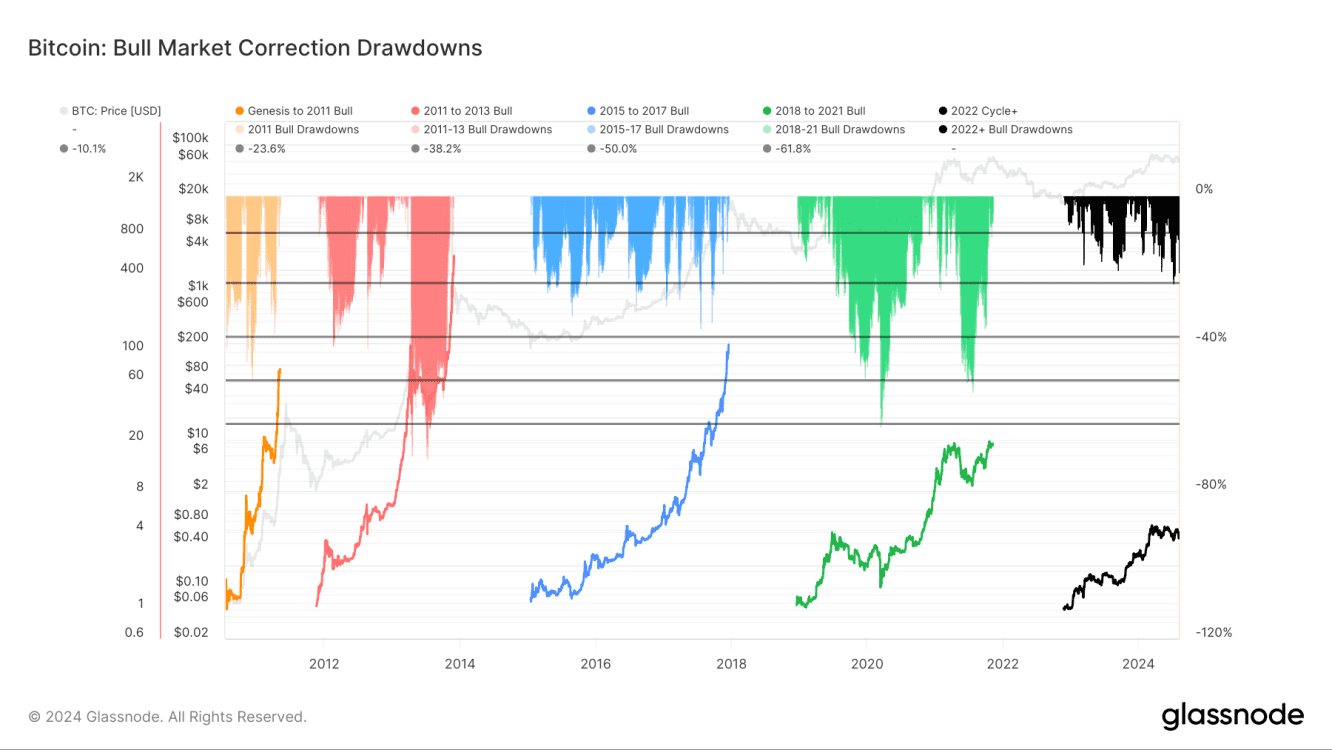

Nevertheless, when analyzing Bitcoin’s prospects, additional factors must be considered. Firstly, the market has been pressured in the last two months by the return of 96,000 BTC ($6 billion) to former Mt. Gox clients and the sale of 50,000 BTC ($3 billion) by the German government. Secondly, Bitcoin has always been and remains a highly volatile instrument, and the current correction is still within the normal fluctuations of a growing market. In previous bullish cycles, maximum drawdowns reached 40-60%.

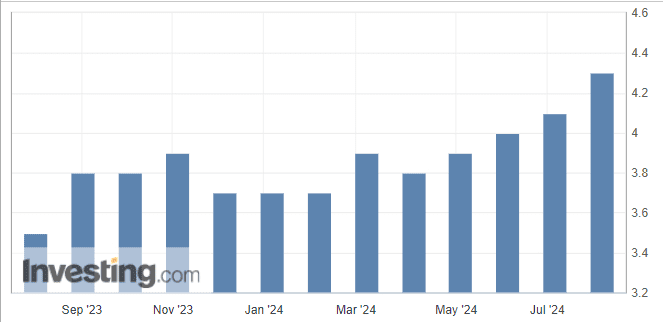

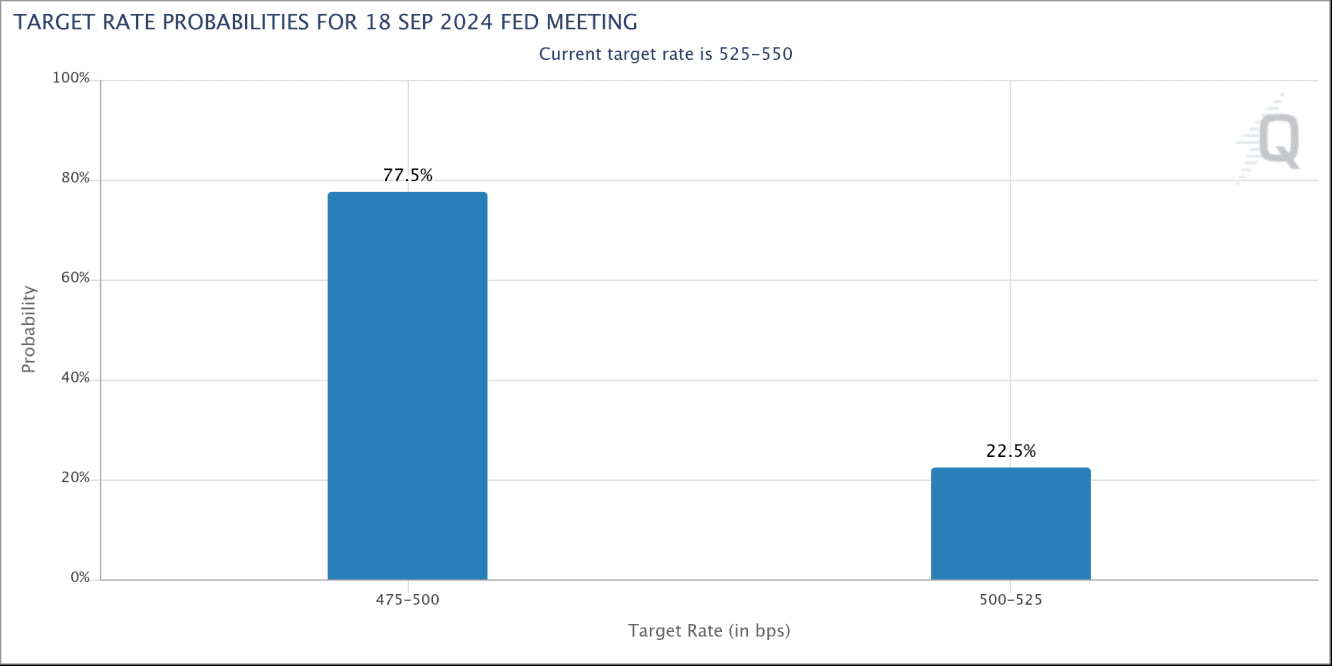

Macroeconomic factors remain favorable: the reduction in supply due to the halving, the recognition of BTC as an investment asset, and the growing number of companies with crypto reserves. It’s also worth noting the likelihood of a Fed rate cut: rising unemployment could prompt the regulator to accelerate monetary policy easing. Currently, the probability of a 0.5% rate cut in September is 78%, up from 30% last week.

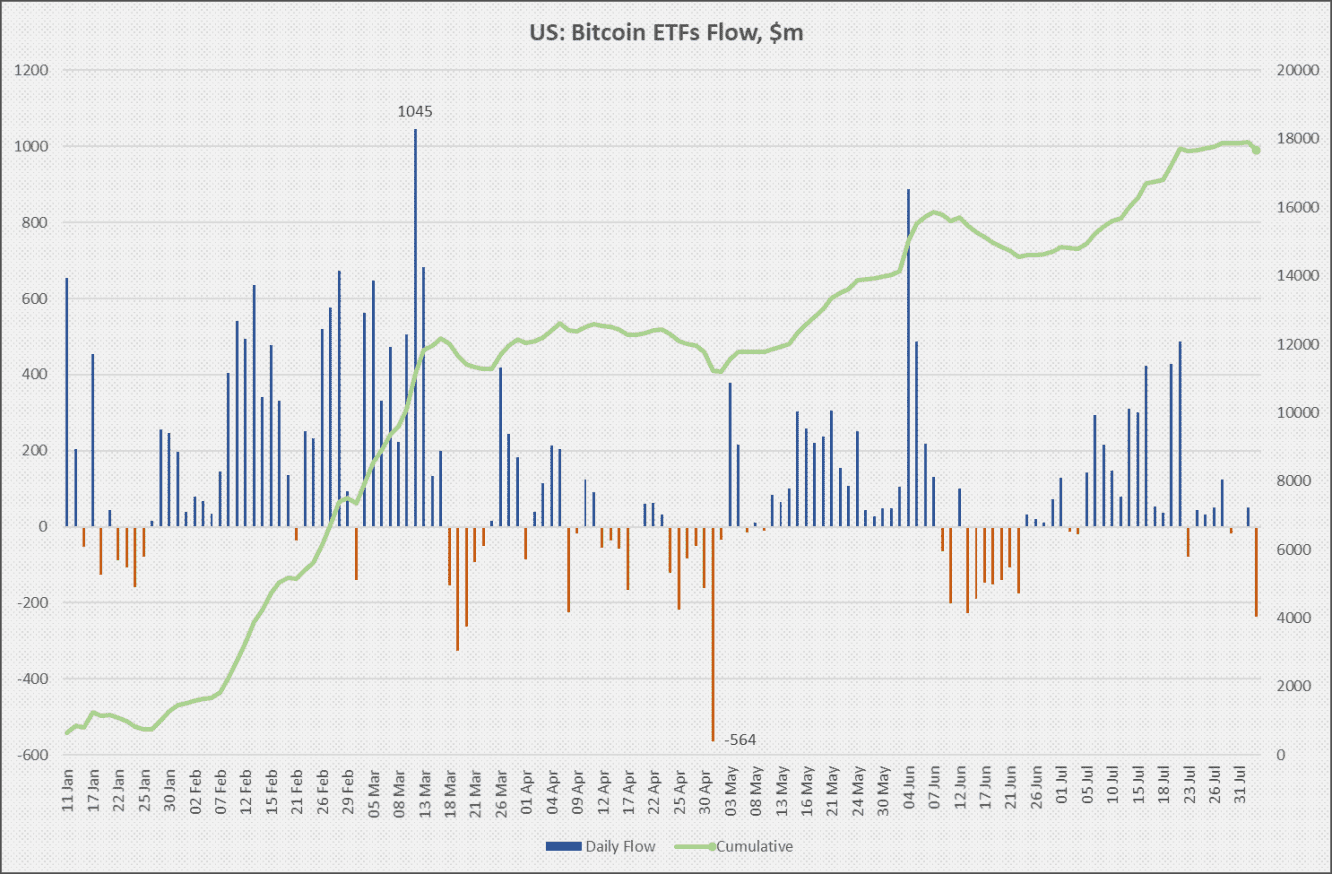

The size of the Bitcoin correction is within typical bounds and would have been significantly smaller without the impact of internal factors such as government coin sales. However, the situation could worsen if US spot ETF investors, who have accumulated $17.7 billion, react negatively to the latest news.

If there is no mass exodus from ETFs, the US government does not begin selling its reserve of 204,000 BTC (~$11 billion), and there is no panic in financial markets, Bitcoin could return to growth and reach a new price high by autumn.

Important: RevenueBot does not provide financial advice; the information is for informational purposes only.

Your Ultimate Guide to Bitcoin Ordinals

In the ever-evolving world of blockchain, more and more innovative products are being developed, pushing the boundaries of what can even be achieved with digital assets. Bitcoin Ordinals have been by far one of the latest, most unputdownable and debated products of these recent years. These unique IDs pegged to sats (satoshis, Bitcoin’s smallest units) are an entirely new way of storing and transferring crypto assets, unlocking vast opportunities for creating and collecting digital artworks, texts, and videos. In this article, we will explore what exactly Bitcoin Ordinals are, the way they work, their distinctions from regular NFTs, as well as discuss their pros and cons.