Stop-Loss mechanism implemented.

Stop-Loss has been implemented in response to numerous user requests. Stop-Loss mechanism is enabled and configured in bot filters when it is created/edited in the «Bots» menu.

At the moment, two conditions for triggering the Stop-Loss mechanism are implemented:

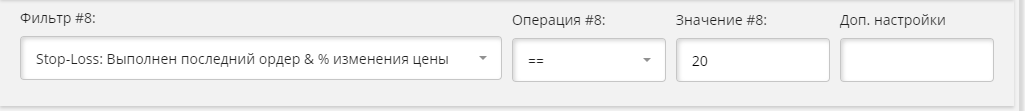

1.The last order of the bot’s safety net was executed and the specified % price change from the price of the last order of the safety net was reached.

For the original LONG algorithm: If you have completed the entire set of insurance orders and the price has continued to decrease from the price of the last order in the grid to the required percentage value, then cancel the current cycle take-profit order, and then send to the exchange the order to market, thereby recording the loss.

For the original SHORT algorithm: If the entire safety order grid is completed and the price continues to increase from the price of the last order in the grid to the required percentage value, then cancel the current cycle take-profit order, and then send to the exchange a purchase order for the market, thereby recording the loss.

To enable Stop-Loss you need to select a sign == in the «Operation» field and set the value in the field to a number of the desired percentage, at which time Stop-Loss will work. You do not need to set any more settings.

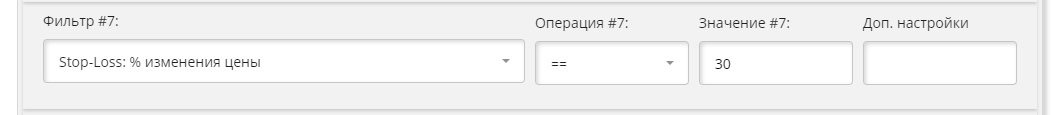

2. The specified % price change from the price of the bot’s first order has been reached.

For the original LONG algorithm: if the price is lower than the price of the first grid order at the right value in percentage, then cancel all active orders of the current cycle, including the take-profit order, and then send to the exchange the order to sell on the market, thereby fixing the loss.

For the original SHORT algorithm: if the price has increased from the price of the first grid order by the desired value in percent, then cancel all active orders of the current cycle, including the take-profit order, and then send a buy order on the market to the exchange, thereby fixing the loss.

To enable Stop-Loss you need to select a sign == in the «Operation» field and set the value in the field to a number of the desired percentage, at which time Stop-Loss will work. You do not need to set any more settings.

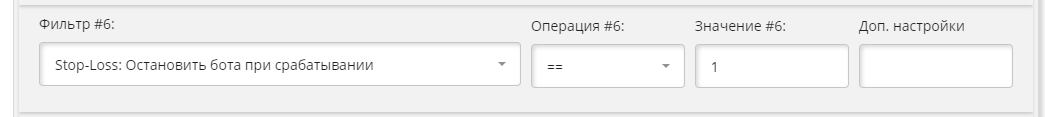

By default, after Stop-Loss is activated, bots will not stop, but start a new cycle. If you want the bot to stop after the Stop-Loss operation and not start a new cycle, turn on the filter «Stop bot when activated».

To enable this filter you need to select == in the «Operation» field and set 1 in the “value” field. You do not need to set an additional setting.

Stop-Loss settings are available in simulation mode.

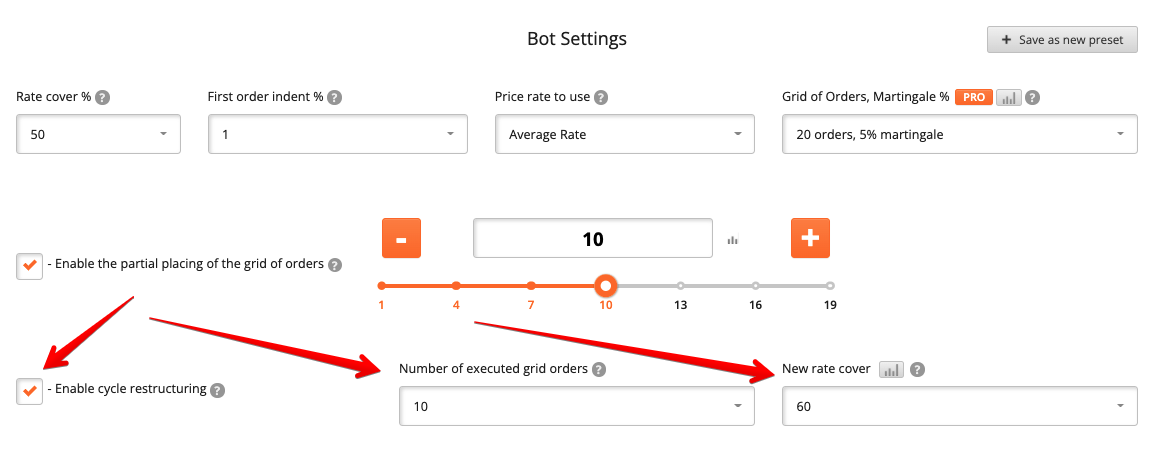

Restructuring the bot cycle

In order to reduce the risks of trading and expand the bot’s averaging capabilities with high volatility, we implemented a mechanism for restructuring the active cycle of the bot.

Using this mechanism, you can increase the value of the tuning «overlapping price change (%)» in the current active cycle of the bot.

The new value will be applied when the specified number of orders of the safety net is executed on the exchange.

Thus, you can move the prices of the remaining (new) insurance orders further away from the current exchange price when the price changes strongly and part of the bot’s insurance orders have already been executed.

You can include cycle restructuring in the «Bots» menu when creating/editing a bot.

The configuration is in the basic configuration unit of the bot.

In addition to the setting itself, you must specify:

— “Number of grid orders executed”.

It sets the cycle restructuring mechanism to work. When the specified number of orders is executed on the exchange, the new value of the “price change overlap (%)” setting will be applied to the remaining grid orders.

— “New price change overlap”.

After setting up «cycle restructuring» you can see what kind of price grid you will get by clicking «Show Order Grid».

The «cycle restructuring» configuration is also available in simulation mode.