In the previous week, there were slightly different expectations from the main cryptocurrency. We saw the end of the correction, but the continuation of the rally did not happen. It has been suggested that this Bitcoin price movement was related to the performance of Fed head Jerome Powell. Investors are waiting, because it could have had a big impact on the movement of the price of digital gold. We will not focus on it, but it is worth noting that there have been many important statements. Based on this, it is possible to make a small forecast of further BTC movement for the next 7 days.

BTCUSD Forecast

The rise of Bitcoin in recent days has been dictated solely by the statements of Fed Chief Jerome Powell at the last US central bank meeting. This situation in itself is interesting, as Bitcoin, for the first time, reacted clearly and clearly to monetary policy, in fact placing itself among the assets in demand in the world economy. What did Powell say?

The quantitative easing program is not going to be scaled down, rates are not going to cut, the inflation target is over 2%, and the economy as a whole is far from recovering. The expected exit date for monetary and fiscal policy was 2023. As a result, risky assets are up, Bitcoin is up, the dollar is down. Given all of the above, and an approved $1.9 trillion stimulus package, it is most likely not worth waiting for Bitcoin to fall.

At the moment, the BTCUSD course remains “held up” between support zones in the range of $54,000 and resistance zones in the range of $60,000. In the event of a $60,000 breach, the price will continue to rise to $70,000 and possibly $75,000 in the near future. In the event of a $54,000 down, the closest target for Bitcoin would be $47,000, which had previously steered the price upwards and acted as short-term support. The most important and key area of support today is the $44,000 level, and it is only by the fact that it is down that we can begin a cycle of decline.

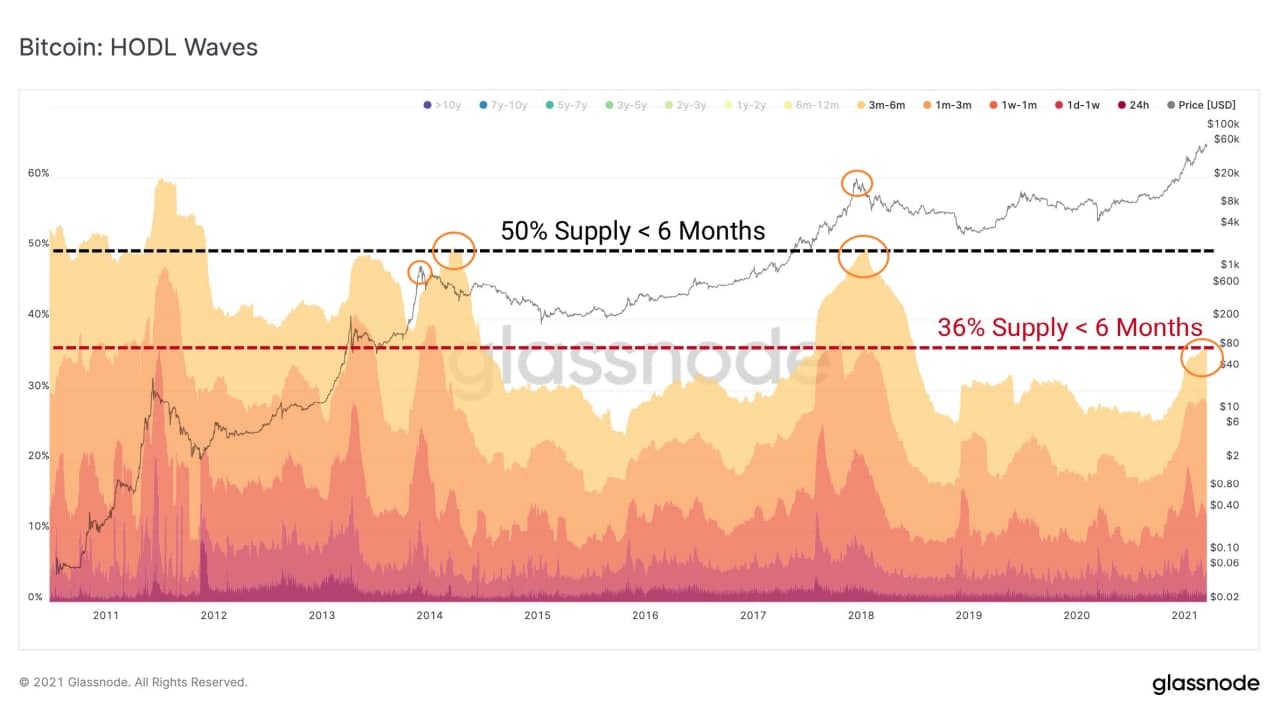

In addition to the Fed head statements that supported the risk asset market and bitcoin, Glassnode’s analysis service also indicates a continuation of the rally. The thing is, in bull markets, old coins tend to move more. The point is that in bull markets, old coins tend to move more. This increases the relative supply of younger coins in the net. At previous peaks, about 50% of Bitcoin’s offer was younger than 6 months, and currently the offer is significantly lower than that and is only 36%. If we focus on the previous rallies, then today bitcoin still has enough chances to grow to $ 75,000 at least.

Based on all the above information we can predict that in the coming week we will see the price of bitcoin coming out of the sidewall. After that, the value of the main cryptocurrency may well be close to $70,000, and in the best-case scenario, it may be even higher.