Both the traditional and cryptocurrency markets stand as two essential pillars of the modern financial system, each with its own unique dynamics and features. As technology advances and the world economy evolves, crypto has grown to become a mainstay on the global stage, sparking interest among investors and common people alike. So how can you tell apart the traditional market and the crypto one?

In this article, we will delve into the key aspects that let us distinguish between these two types of markets. What we will also do is analyze the fundamentals of operation, regulation, liquidity, and much more in order to help you get a better sense of each type of markets and the opportunities they offer.

What is Forex Trading and how it works?

The Foreign Exchange Market (aka forex, FX, or the international currency market) represents one of the largest and most liquid financial markets globally. Operating around the clock, it provides market players with a vast spectrum of opportunities to trade currencies.

The forex is a decentralized international market where currencies of different countries are being exchanged. Among the main participants in this huge deal-making space are banks, financial institutions, corporations, and individual traders. It has no physical location and all the trading there is performed through electronic platforms.

In this kind of market, trading takes place by simultaneously buying one currency and selling another. Currency pairs consist of a base currency and a quoted one, with the value of the pair determined by the ratio of their exchange rates. Say, for the EUR/USD pair, the base currency would be the euro and the quoted currency would be the U.S. dollar.

Trading in forex is a real-time activity so prices are constantly changing due to a variety of factors such as economic news, political events and global trends. Traders always try to anticipate the direction of price movements and execute trades in order to generate more profits.

The forex is characterized by high liquidity, which implies that at any given point of time you can strike a deal at the latest market prices. In addition, at the FX market, a great variety of currency pairs exist, which provides traders with a broad range of options.

In terms of regulation, it has many aspects that require authorities’ attention. Each country has its own authorities responsible for supervising and registering the activities of brokers and market participants.

Thus, the FX is a truly unique space for traders, providing numerous avenues for investing and speculating on foreign exchange rates.

What is crypto trading and how does it work?

Nowadays, the crypto market ushers in a new era in the world of finance, bringing unique insights for those seeking alternative ways of investing and trading.

Cryptocurrencies are traded on specialized platforms (called crypto exchanges or CEXs) where customers can swap various cryptocurrencies for other similar digital assets or otherwise exchange them for fiat money such as dollars, euros and other national currencies. These transactions are done online and usually require you to create an account on the desired exchange.

By far one of the main peculiarities of cryptocurrencies trading is their volatility. Crypto prices can swing dramatically within a short period of time, giving traders the chance to profit from both uptrends and downtrends. Volatility appeals to investors willing to take risks in search of sky high revenues.

Cryptocurrencies are powered by blockchain technology, which ensures transparency and security of transactions. A blockchain is basically a chain of blocks, each containing information about a multitude of transactions. These blocks can neither be modified nor deleted, which guarantees the reliability and authenticity of the data.

Thanks to the such a far-reaching technology that underpins all cryptocurrencies, transactions are safe and see-through. It all makes cryptocurrencies alluring to those who value privacy and security in their financial transactions.

Crypto vs forex trading: similarities and differences explained

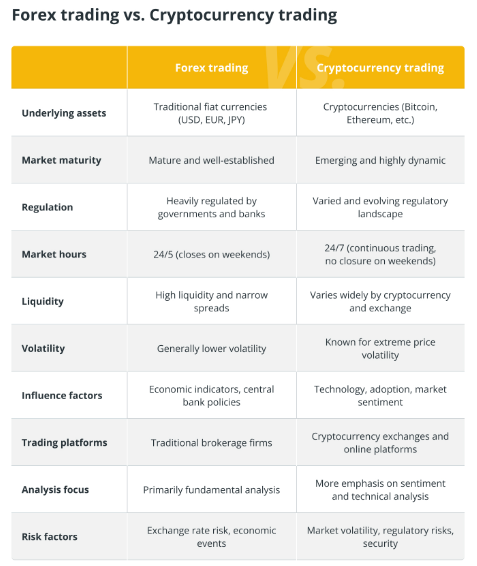

Now that we have covered the basics of trading on both forex and crypto exchanges, let us analyze the key distinctions and commonalities between these two types of markets.

- Liquidity and volatility: At Forex, liquidity is provided by large financial institutions, making it one of the most marketabe avenues in the world. The crypto market, on the other hand, is more volatile due to the lack of centralized management and the low market capitalization of some currencies. This means that crypto prices can swerve at a much faster rate, offering more opportunities for short-term profits.

- Regulation: The FX market is tightly regulated in most countries, keeping transactions transparent and secure. Cryptocurrencies, by contrast, are far less regulated, which could elevate risks for investors due to potential fraudulent schemes and a lack of consumer protection.

- Trading hours: The Forex market operates 24/5, which means that trading is available nearly every day and night from Monday to Friday. In turn, crypto is available for trading 24/7, with no weekends or holidays, which provides flexibility for traders from different time zones.

- Accessibility: Forex trading usually requires more traditional methods of financing through banks or payment processors. In contrast, crypto trading can seem more accessible, as many exchanges allow you to buy them using credit cards or e-payment systems.

Conclusion

To sum up, both markets provide unique opportunities for investors and traders. The FX due to its stability and liquidity is often preferred by experienced investors. And the crypto market, with its high volatility and agility, is attracting new players and those looking for higher risks and opportunities for quick profits.