With the help of revenuebot users can conduct automated trading on the exchange Binance.

Automated trading can be done with the cryptocurrency trading bots built for Binance, in other words, with the automated software that buys and sells according to certain rules like the desired price. Free Binance bots have the potential to increase revenue, as well as mitigate risks. Find out more about cryptocurrency trading on Binance, as well as bots offered by revenuebot .

Founded in 2017, Binance is the largest crypto exchange by trading volume and number of participants. It is the first platform to have its own BNB token. The exchange has a regulated stablecoin, BUSD, backed by fiat currency and pegged to the US dollar. For every BUSD issued, its issuer has one dollar in reserve. The use of the revenuebot's auto trading bots available for the classic Binance Spot, as well as trading in perpetual futures contracts Binance Futures USDS- M and Binance Futures COIN-Ⓜ. Thanks to the variety of settings available, the user of the service can create an effective Binance automated trading bot and start trading in a short period of time.

General information about Binance Spot

Binance Spot is a division of the Binance cryptocurrency exchange that provides spot and margin trading (with 3x cross-margin and 10x isolated margin). More than 370 cryptocurrencies are represented on the exchange, from which many trading pairs are generated.

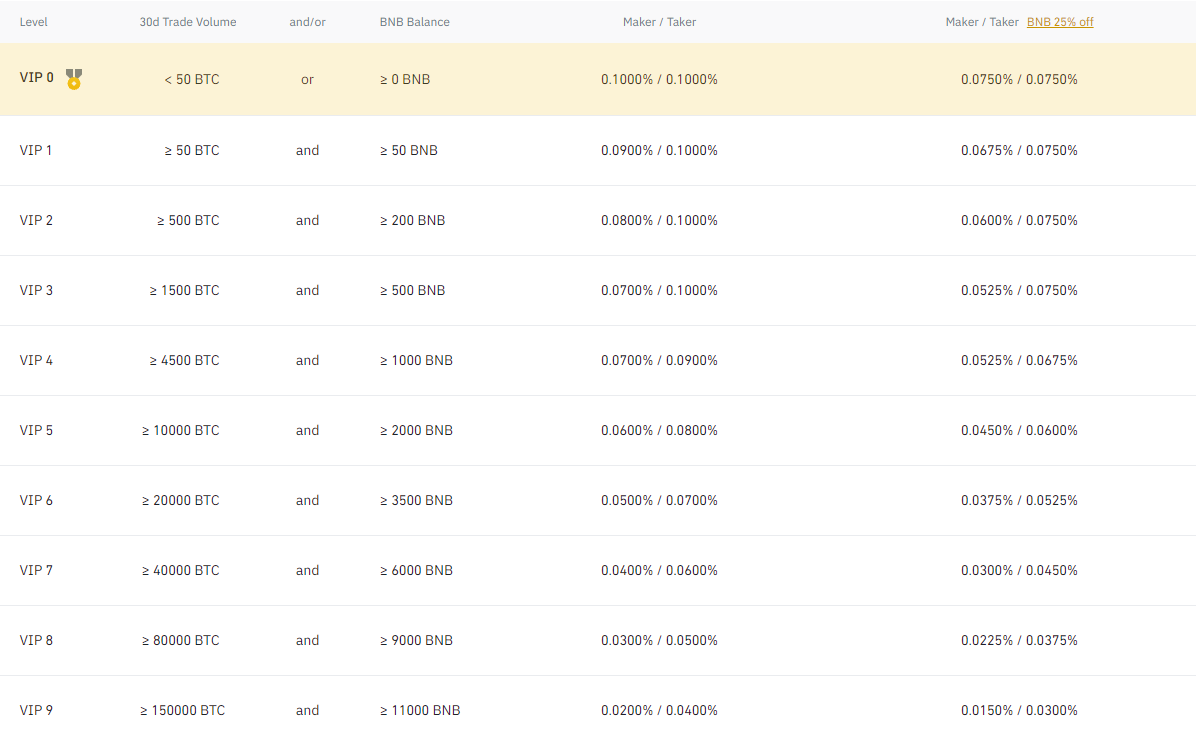

Binance Spot fees

Trading fees on Binance Spot depend on the daily trading volume and the number of BNB tokens in the account. In addition, the exchange has a referral program that allows you to receive referral cashback, that is, to return a part of the paid trading commission. To do this, you need to enter the referral ID code during registration. On Binance SPOT, referral cashback can be up to 30%. More details about the exchange commissions can be found in the table below:

General information about Binance Futures USDS-M

Binance Futures USDS-M is a division of the Binance cryptocurrency exchange, which provides trading in futures contracts for cryptocurrencies, where the base currency is stablecoins (USDT, BUSD). The maximum leverage is 125x, however, from July 2021, the exchange has introduced restrictions for new users: 20x leverage is initially available, and will gradually increase. Using futures, you can fully short, making a profit in a falling market (Open a SHORT position and make a profit during a bearish trend, so as not to lose your funds). Perpetual futures contracts allow you to keep a position open for as long as you want.

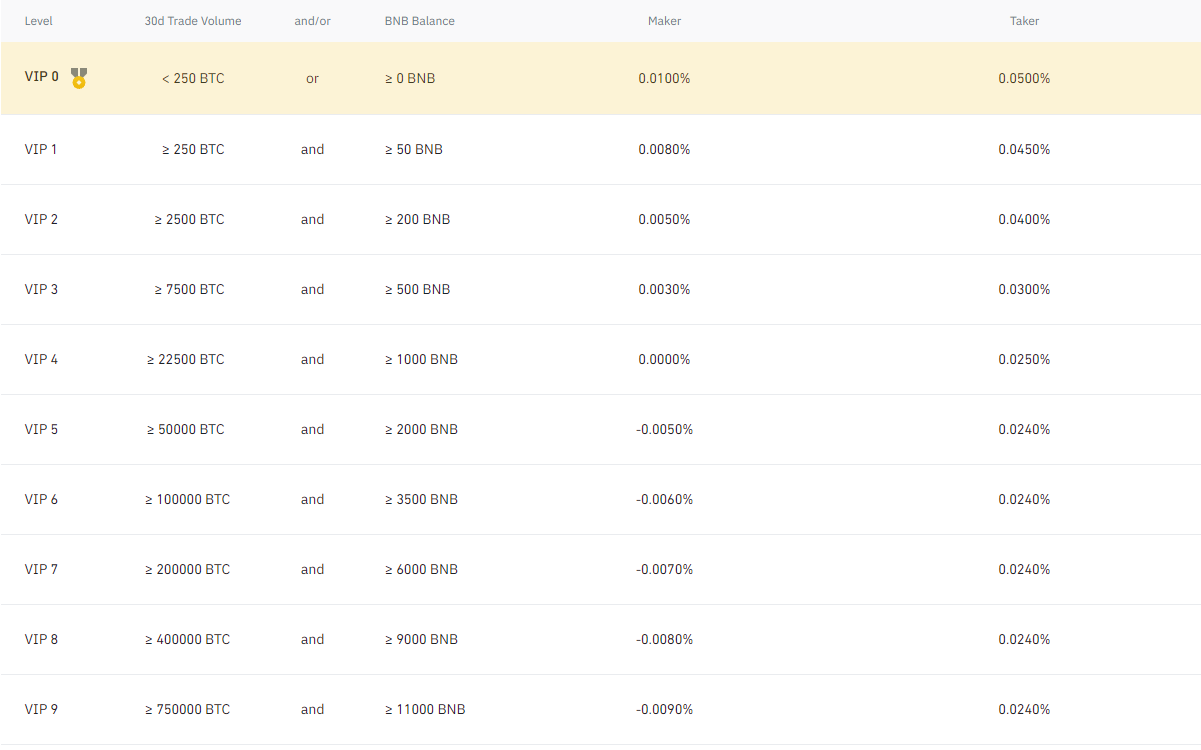

Binance Futures USDS-M Fees

Trading fees on Binance Futures USDS-M depend on the daily trading volume and the number of BNB tokens in the account. It is also possible to pay commissions with a BNB token, for which a 10% discount is provided. More details about the exchange commissions can be found in the table below:

General information about Binance Futures COIN-Ⓜ

Binance Futures COIN-Ⓜ is a division of the Binance cryptocurrency exchange that provides cryptocurrency futures trading. For COIN-Ⓜ futures, the base coin is BTC and a number of other cryptocurrencies (ETH, ADA, LINK, BNB, TRX, DOT, EOS, LTC, BCH, XRP, ETC). Each trading pair has its own base coin.

There are currently 12 trading pairs available on the Binance Futures COIN-Ⓜ exchange:

BTC-USDETH-USDADA-USDLINK-USDBNB-USDTRX-USDDOT-USDEOS-USDLTC-USDBCH-USDXRP-USDETC-USD

For COIN-Ⓜ, USD is the counter coin being traded.

The price of 1 futures contract = 100USD for the BTC-USD pair.

The price of 1 futures contract = 10USD for ETH-USD, ADA-USD, LINK-USD, BNB-USD, TRX-USD, DOT-USD, EOS-USD, LTC-USD, BCH-USD, XRP-USD, ETC- USD. When working with these contracts, the cryptocurrency is used to finance the initial margin (the initial depot for the Binance bot is needed in the base coin) and to calculate profit and loss (the profit is also made in the base coin).

Binance Futures COIN-fees

Trading fees on Binance Futures COIN-Ⓜ depend on the daily trading volume and the number of BNB tokens in the account. More details about the exchange commissions can be found in the table below:

Trading security on the Binance exchange

According to Binance's management, 95% of customer funds are kept in cold wallets, the remaining 5% are kept in hot wallets for instant settlements. From the security measures that the exchange offers to its customers, the following are available:

Installing the Security KeyGoogle Authenticator connectionAccount login confirmation by phone number and emailWhitelist for withdrawing fundsAnti-phishing codeManage devices that are allowed to access your account

Сyberbot Automated trading

How trading bots took over the market

According to statistics, about 70% of transactions in the stock market are made using various bots just like Binance bots by revenuebot. And given that the crypto market mainly adopts practices from traditional ones, there is no doubt that the percentage here is not less. Why are traders less likely to trade themselves and trust bots to do it? There are several reasons to use a crypto trading bot for exchanges like Binance:

The software or a Binance auto trade bot has no human factorA trader can make a mistake when filling out an order, forget to close it, or do something else. A software or a Binance order bot trades only according to the settings that were originally included in it, so the possibility of errors or inaccuracies is excluded.-

Speed of the whole processA trader cannot analyze several trading pairs or markets at the same time. In addition, you will have to open many trades. Trading bots for Binance do a great job with all these tasks. Versatility and scalabilityHaving a clear trading strategy, you can run many Binance bots for simultaneous automatic trading on different crypto-exchanges and trading pairs.-

Trading will be carried out at any time of the dayTrading bots do not need time to sleep and rest, so they can trade on Binance around the clock, making a profit for their owner.

Cryptorobotics Trading on Binance with RevenueBot

How to earn more with cryptorobotics trading bots on Binance

We have been on the market since 2018 and over the entire period of our existence, we have carefully worked out all the features of working with the Binance exchange like developing the crypto trading bots for the benefit of our users. Since May 2021, we have been an official partner of and have been participating in the Binance exchange brokerage program.

Advantages of using a trading bot on Binance by REVENUEBOT

Here are the advantages of cryptocurrency trading bots for Binance by Revenuebot:

- Variety in the functionality and settings of the Binance trading bot, which allows you to implement many trading strategies:

The Smart Grid of Safe Ordersallows you to create efficient DCA bots for Binance with LONG and SHORT algorithms using an averaging strategy.The automatic switching of the Binance bot's trading pairsignificantly increases the number of profitable trades. Using the volatility analyzer developed by us for the Binance exchange, the bot can automatically select the best trading pair in terms of volatility so as not to be idle.Using TradingView signalsas a condition for starting a bot trading on the Binance exchange allows you to implement strategies based on a variety of trading indicators.The free Binance trading bot’s simulation modewill show how the Binance bot you created would trade over the last 60 days (the time and date of the start of the simulation can be set in the settings). We keep a history of price changes for all trading pairs on the Binance exchange over the past 60 days. All tests will be carried out on the chart of your chosen trading pair, for a specified period of time. This will allow you to verify that your Binance bot’s settings are correct or to identify inaccuracies.The automatic algorithm flippingwill allow you to implement a risk hedging strategy when trading with automated bots on the Binance exchange. At the moment when the price goes in the wrong direction, the second Binance bot will be automatically connected, which has the opposite algorithm.

- The user pays nothing if the Binance bots do not make a profit. The commission for using the service begins to be charged only from the moment the Binance bots makes a profit. The commission is 20% of the profit received, but not more than 50 USD per month, for each of the three types of trading: SPOT, Futures USDS-M, Futures Coin-M.

- The user does not need to keep their computer turned on 24/7, because the Binance bots functions from the cloud storage.he trading bot will conduct transactions on Binance at any time of the day.

- We have a marketplace where you can buy a ready-made Binance crypto trading bot configuration, sell a profitable one and get additional income, as well as purchase a mentoring service from an experienced user.This helps users to start at any moment: there is no need to build a Binance trading bot, one can choose the right one and start earning.

- How to make your own Binance trading bot? Easy. Users can also create a Binance trading bot from scratch by configuring settings.

- There also is a referral program through which clients of the service receive an income without even starting a trade.