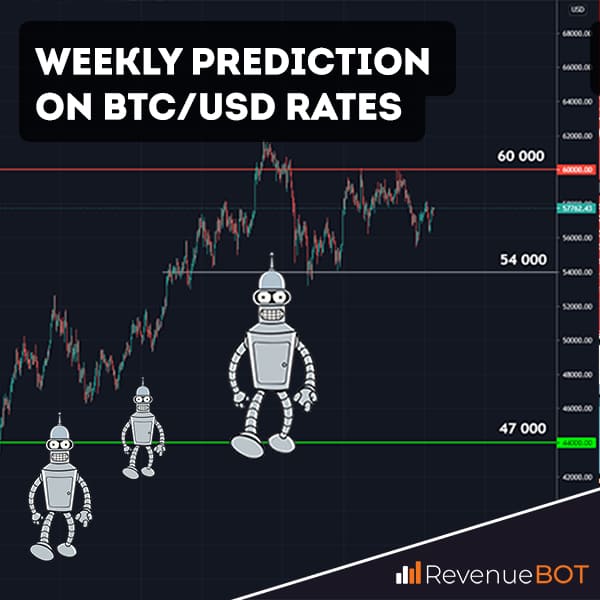

At the beginning of last week we expected a slightly different development: Bitcoin was to update ATH and continue the upward trend. Instead, however, there has been a backsliding of up to $50,000. The main cryptocurrency is now traded in a wide range between $57,000 and $52,000. Let’s try to figure out what the BTC is waiting for next week.

BTCUSD Forecast

On 25 March, Bitcoin attempted to break through the support zone in the area of $52,000, but failed to do so, again confirming the theory that bulls were still strong in the market. Currently, the price is close to two resistance lines:

- Dynamic – short-term downtrend (white).

- The liquidity accumulation zone is $58,000 (red).

Both levels can push the price down, in which case the price ceilings will not be updated again. Lowering the price caps that form the resistance line is a bad thing. In order for the bulls to show strength, it is important to overcome both levels and then the task will be left to the small – to update the historical maximum and go even higher.

On Friday, March 26, a major expiration of bitcoin options took place, which some traders and analysts were afraid of. However, any date of expansion could have both a positive and a negative impact on the price. To put it simply, there is no particular role for experimentation, as there are buyers and sellers in the options market. However, data from the Deribit Options Exchange show that after Friday’s expansion, the mood in the BTC options has shifted to a bull’s-eye: investors expect $80,000. Thus, market sentiments are much less negative than positive today.

It is also worth remembering that a new $1.9 trillion stimulus package in the US has been allocated, with a large portion of the country’s population receiving $1,400 checks, which are likely to be traditionally used to buy shares, cryptocurrencies, and other risky assets.

Based on all available information, the following projection can be made: In the coming week, the main cryptocurrency can upgrade the ATH in the range of $70,000, but only in the event of a breach of $58,000. If that doesn’t happen, there’s a good chance of going back $52,000 or less.