As expected, the previous week passed without visible changes for the crypto market. The sideways trend will last until the news is either positive or negative. It should be an eventful week. To start with, the Fed will finally take action on the rate issue at a meeting, and the Russia-Ukraine conflict there is progress in negotiations. Let us break down what the coming week will be like considering crypto market in the this weekly bitcoin-to-dollar forecast

BTCUSD exchange rate forecast

At the moment, the former of these cryptocurrencies remains between $36,000 and $44,000. This week could set a future trend depending on what level bitcoin breaks through. If the support level won’t be able resist, chances are that Bitcoin will go down to $30,000 or even lower. In this case, the probability of continuing downtrend will increase. If it breaks through the area of $44,000, there is a high probability of an equally impulsive rise to the area of $52,000. In other words, the denouement is close. What exactly it will be depends on what level will be taken.

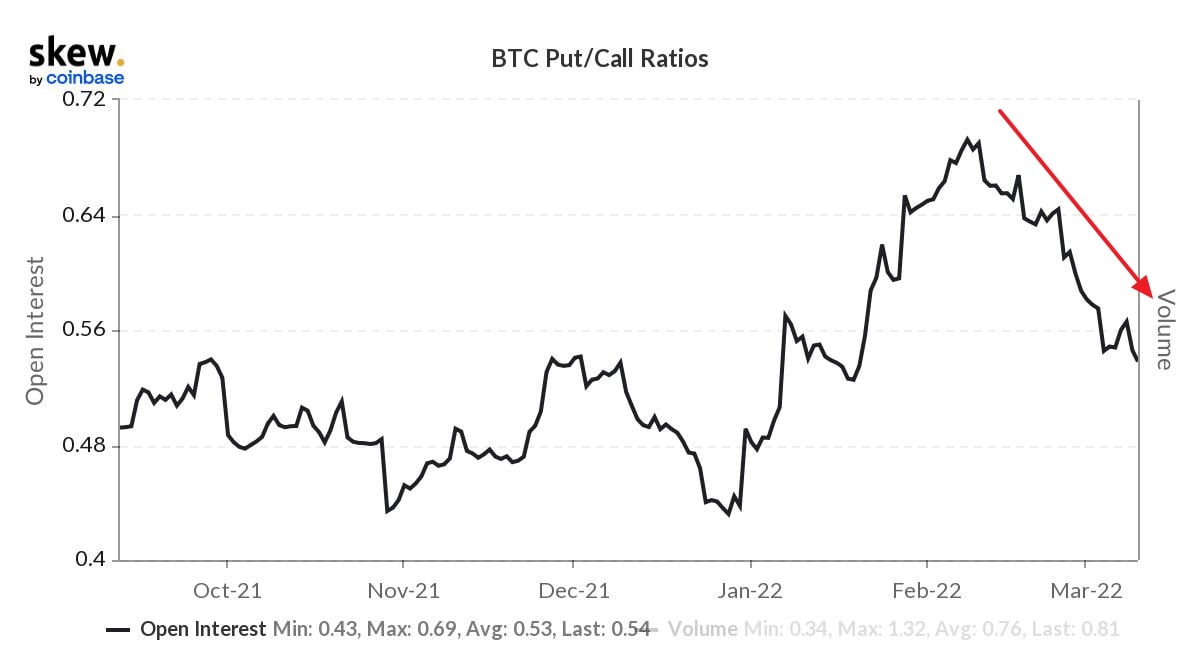

According to data from the analytical platform Skew, you can see a bullish sentiment if you focus on the ratio of Put and Call options. In the short to medium term, investors increase their buying positions and decrease their selling positions. This suggests that they are expecting the market to grow.

On March 16, there is a meeting of the Fed, which will be a turning point for the market of risky assets. Should the Fed’s expected action occur, there is a chance that the market will respond with growth. In the event there is a tightening, risky assets will drop.

If the tightening is more lenient than expected, risky assets will still give way. We do believe that the financial markets news will be more positive, helping the crypto market break above $44,000.

Our bitcoin (BTCUSD) forecast for today, tomorrow and the week of March 14 to March 20 is an exit from a sideways trend, either above $44,000 or below $36,000, depending on how investors respond to events that will occur in the coming week.