Two years ago, the U.S. Securities and Exchange Commission (SEC) filed a lawsuit considered to be one of the most prominent enforcement actions related to cryptocurrency selling since the industry’s inception.

The lawsuit was filed against Ripple Labs, an XRP token creator, which at the time was the leading cryptocurrency by market cap totaling $27 billion. By the end of the month during which the complaint was filed, Ripple’s market cap had plummeted to $16 billion. The SEC alleged in its complaint that Ripple and related defendants violated sections of the Securities Act of 1933 by engaging in illegal offerings and sales of securities in exchange for cash and other rewards worth over $1.38 billion.

This article discusses some of the news of the SEC case against Ripple in 2022 and what the future holds for the token in question.

SEC vs. Ripple: how it all began

The U.S. regulator showed signs of concern about Ripple back in 2015. It was then that the SEC accused the company of XRP not being a token, labeling the coin an unregistered stock. Ripple paid a $700,000 fine at the door and walked away, but the SEC wouldn’t let it stop there. New charges were made, stating that Ripple Labs managed to raise about $1.3 billion through the sale of unregistered securities.

The crypto community raised a lot of questions to the SEC since then, for the regulator never gave a clear answer as to why they consider XRP to be a security.

Ripple’s protracted and agonizing lawsuit against the SEC has since begun.

The lawsuit caused waves given not only the SEC’s decision to pursue an enforcement action against the issuer of one of the most popular cryptocurrencies in circulation but also Ripple’s quick announcement of its intention to vigorously fight the lawsuit.

The case now has reached a decisive point, as both sides filed motions for summary judgment in mid-September asking the court, in part, to decide the most significant issue in the case: whether XRP is a security that needs to be registered pursuant to the Securities Act. Should the court grant summary judgment with respect to this issue, it will effectively have decided the case. If Ripple prevails on its motion, and the court holds that XRP is not a security, there can be no violation for the sale of unregistered securities. It would also represent the most significant defeat yet in the SEC’s campaign to regulate cryptocurrency.

If the SEC prevails on its motion, however, it will be another victory for the regulator that has repeatedly succeeded in actions against cryptocurrency issuers. If the court denies both motions, the issue will be litigated at a trial on the merits.

The crux of the dispute is whether XRP can be considered an “investment contract” and therefore a security under the Securities Act.

An investment contract is one category of instrument over which the SEC has been granted regulatory authority. The term is not defined in the federal securities laws, but the U.S. Supreme Court in the 1946 landmark case SEC v. W.J. Howey Co. provided guidance on the essential elements of what constitutes an investment contract. It held that an investment contract is an “investment in a common venture premised on a reasonable expectation of profits to be derived from the … efforts of others.” While subsequent cases have refined the test, the essential holding of Howey remains intact.

What’s happening with the XRP token

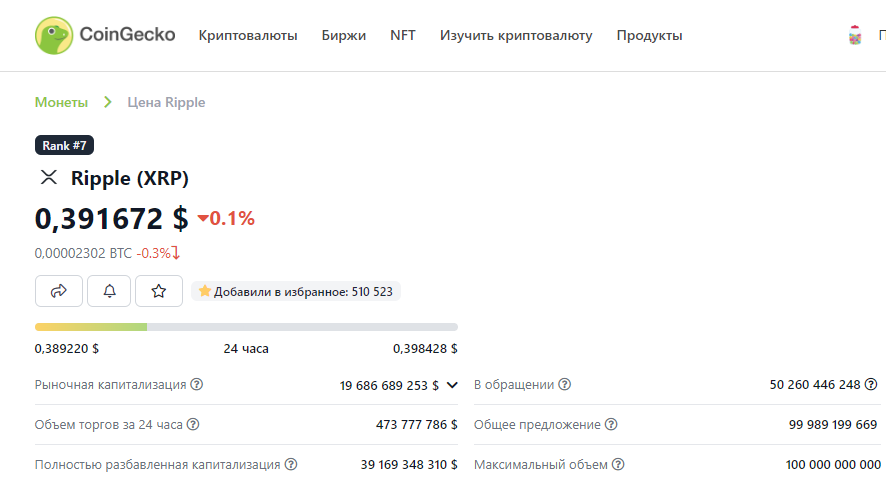

Despite the rather time-consuming trial, the Ripple token still ranks among the top 10 cryptocurrencies according to CoinGecko.

As you can see, the coin is trading at $0.39, well over $19 billion in market cap. That’s certainly a far cry from the token’s all-time high, but the fact that it remains at the top may indicate that people are still curious about the coin.

If you want to buy and trade the coin, you are free to use our cryptocurrency trading bot.

What the SEC says

The SEC argues that XRP falls squarely within the definition of an investment contract under Howey and its progeny. According to the SEC, purchasers of XRP invested in a common enterprise because those purchasers were entitled to receive returns directly proportionate to their stake in the token, or alternatively, the fortunes of the purchasers were tied to the fortunes of the promoter, in this case Ripple, which was the largest holder of the token from its creation.

The SEC further argues it was clear that purchasers of XRP reasonably expected to profit from their purchase, in part because Ripple openly promoted the token as an investment from the outset, marketed and took steps to ensure purchasers’ ability to resell XRP on secondary markets, and touted its efforts to provide and protect the liquidity of the XRP markets, among other reasons. To this end, the SEC argues that XRP purchasers expected their profits to result from Ripple’s efforts.

If the court accepts these arguments, the SEC will have established XRP is an investment contract and therefore is subject to the regulations imposed by the federal securities laws, including that it be registered as a security.

By contrast, Ripple argues that XRP lacks the “essential ingredients” to be considered an investment contract. According to Ripple, every investment contract case prior to 1933 involved an actual “contract,” imposed post-sale obligations on the promoter, and gave the investor a right to receive profits. Ripple contends that none of these characteristics apply to XRP and that no Supreme Court or Second Circuit Court of Appeals case since Howey has found an investment contract to exist without these three characteristics. In response, the SEC accuses Ripple of conceding it could not prevail under existing law and labels the “essential ingredients” argument an attempt to “read three new prongs into Howey.”

Conclusion

A decision by the court on the competing motions is expected soon. If Ripple prevails, the SEC will have been dealt a major defeat, not only because it will have lost one of the most significant cryptocurrency enforcement actions ever brought. The implications of such a decision likely would have widespread effects on future SEC litigation.

But to start trading XRP today, we suggest using the services of a cryptocurrency trading bot, which will not only save your time, but also quite realistically become a source of passive income for at trader of any level.