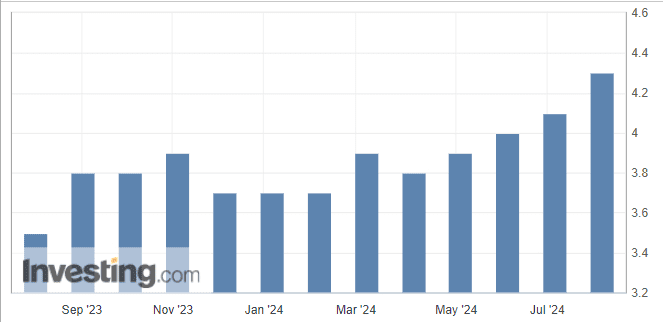

Friday brought unfavorable data from the US: non-farm employment in July was almost halved to 114,000, manufacturing orders fell by 3.3%, and the unemployment rate increased from 4.1% to 4.3%. These figures were significantly worse than forecasted, indicating a possible onset of a recession in the world’s largest economy.

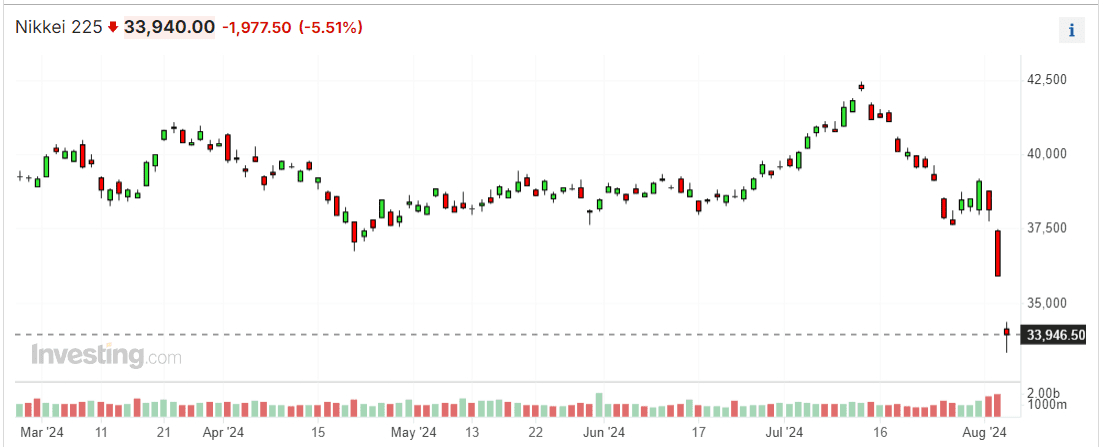

Financial markets worldwide reacted negatively to the emerging risks. The Japanese Nikkei index was particularly hard hit, also pressured by the first key interest rate hike since 2006, to 0.25%. It fell by 11.1% over the week.

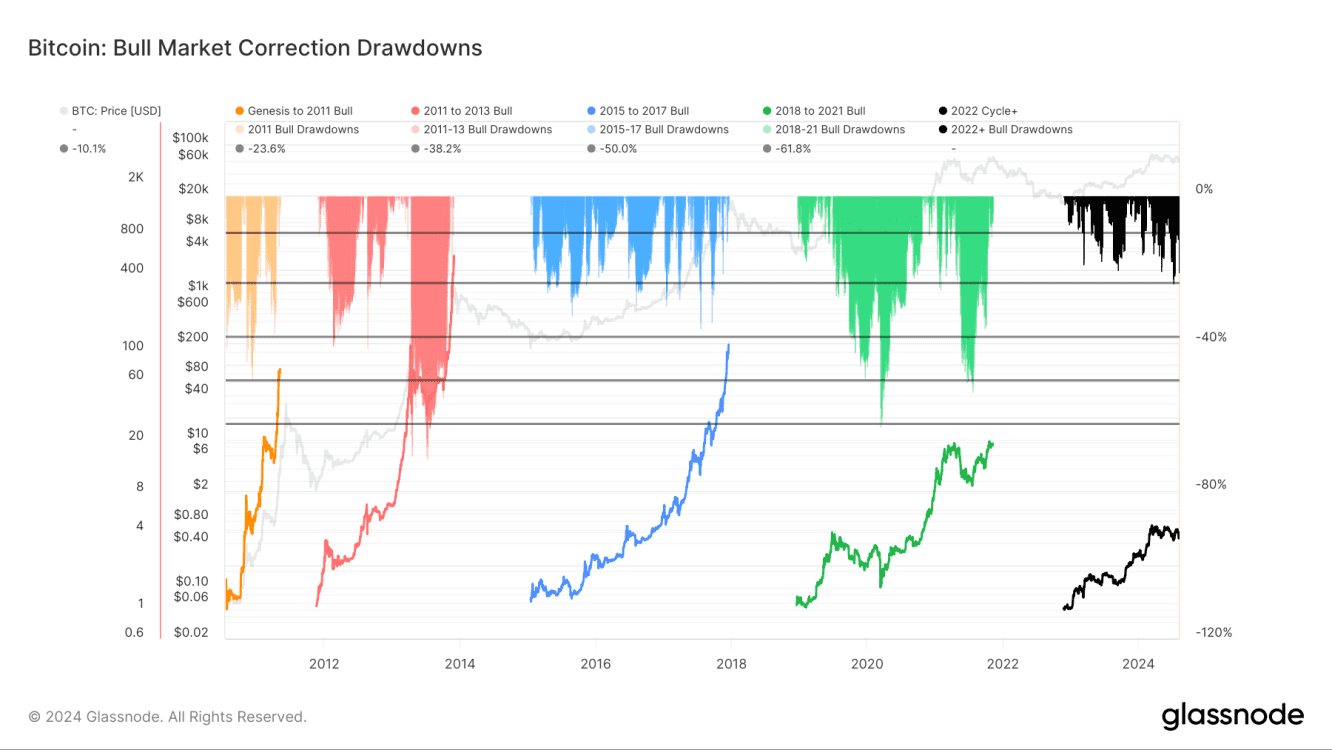

Investor risk aversion did not go unnoticed for BTC either: its weekly drop was 13.2%, the worst since the collapse of the FTX cryptocurrency exchange in November 2022. The decline continued on Monday, with the maximum drawdown from the record high reaching 30%.

Nevertheless, when analyzing Bitcoin’s prospects, additional factors must be considered. Firstly, the market has been pressured in the last two months by the return of 96,000 BTC ($6 billion) to former Mt. Gox clients and the sale of 50,000 BTC ($3 billion) by the German government. Secondly, Bitcoin has always been and remains a highly volatile instrument, and the current correction is still within the normal fluctuations of a growing market. In previous bullish cycles, maximum drawdowns reached 40-60%.

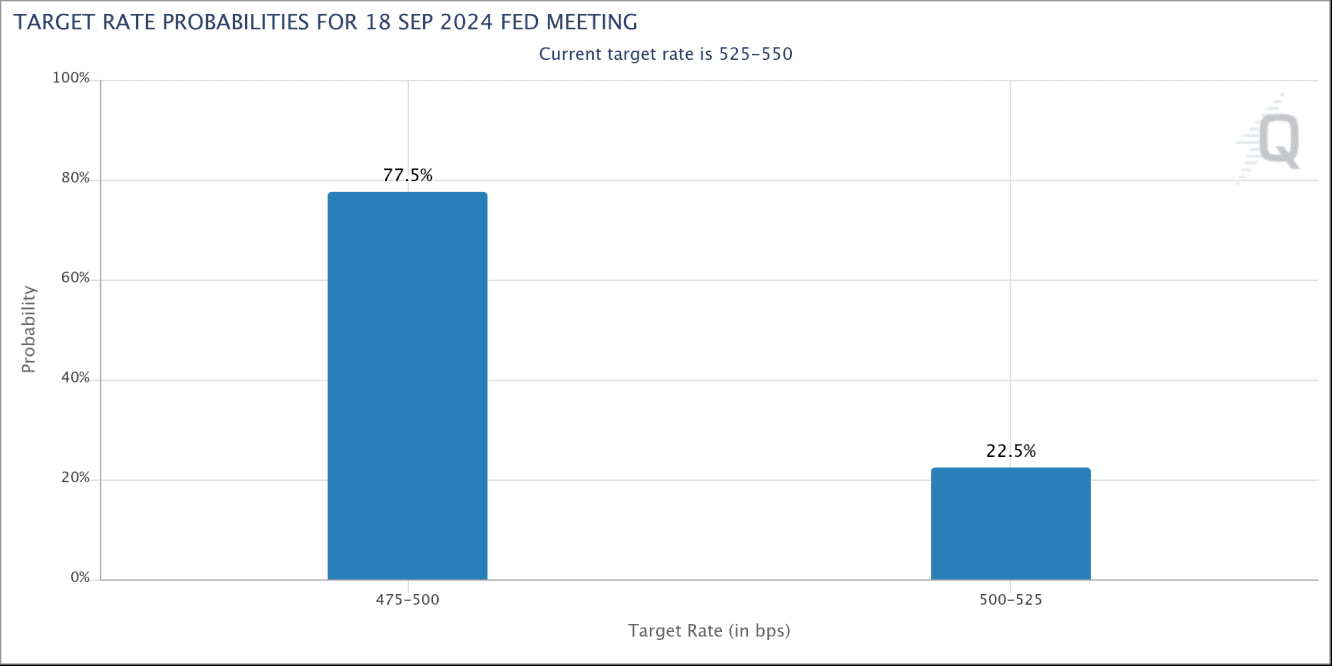

Macroeconomic factors remain favorable: the reduction in supply due to the halving, the recognition of BTC as an investment asset, and the growing number of companies with crypto reserves. It’s also worth noting the likelihood of a Fed rate cut: rising unemployment could prompt the regulator to accelerate monetary policy easing. Currently, the probability of a 0.5% rate cut in September is 78%, up from 30% last week.

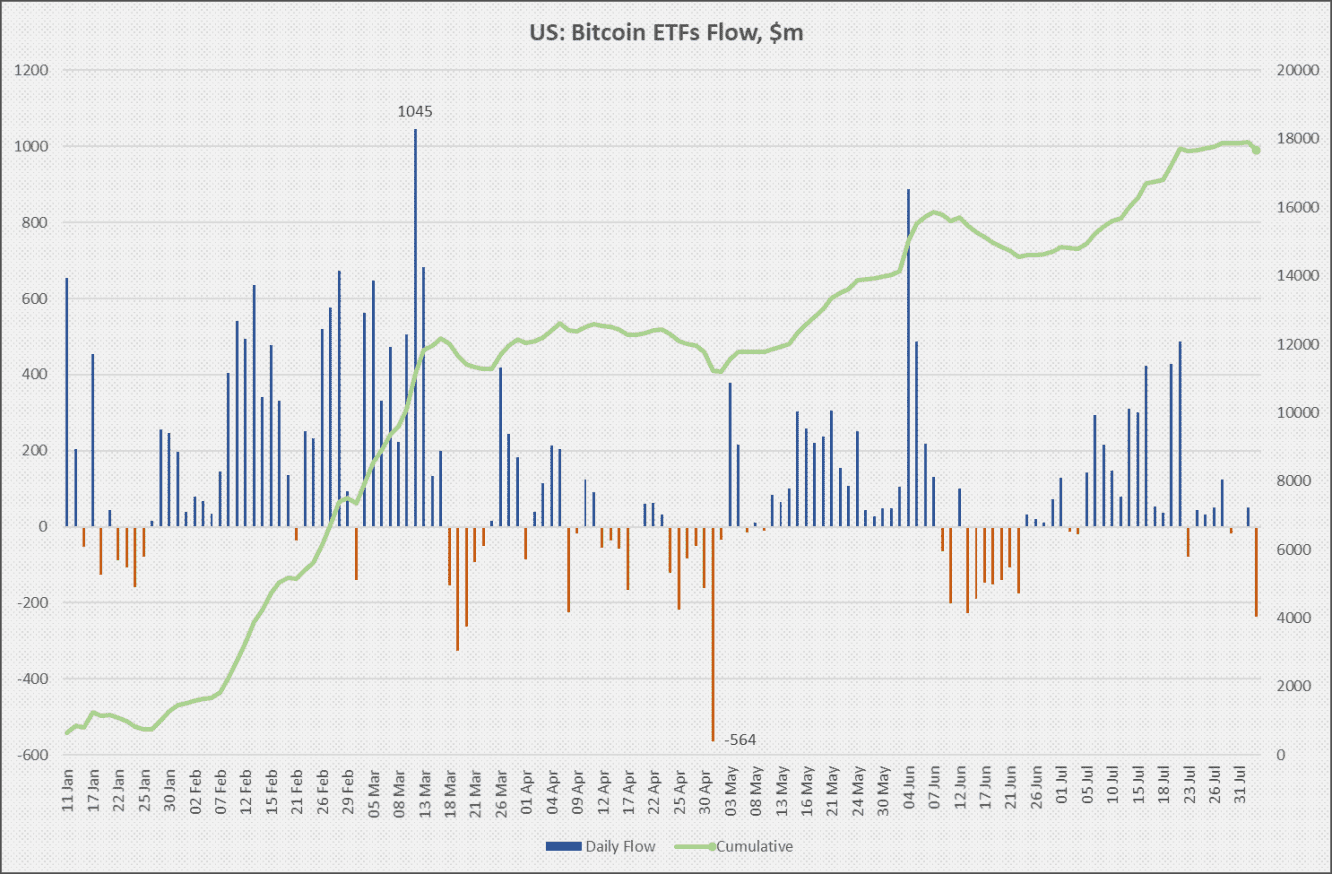

The size of the Bitcoin correction is within typical bounds and would have been significantly smaller without the impact of internal factors such as government coin sales. However, the situation could worsen if US spot ETF investors, who have accumulated $17.7 billion, react negatively to the latest news.

If there is no mass exodus from ETFs, the US government does not begin selling its reserve of 204,000 BTC (~$11 billion), and there is no panic in financial markets, Bitcoin could return to growth and reach a new price high by autumn.

Important: RevenueBot does not provide financial advice; the information is for informational purposes only.