Donald Trump became the 47th President of the United States, causing a sharp rise in Bitcoin to a new all-time high of $79,789 (data as of the time of the elections). The volume of funds in Bitcoin ETFs reached a record $25.49 billion. The victory of the Republican candidate, who promised to make the US the cryptocurrency capital of the world, could radically change the regulatory landscape of the industry in the world’s largest economy.

Political factors determine market dynamics.

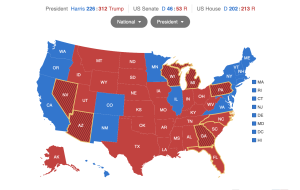

After receiving 312 electoral votes against Kamala Harris’s 226, the market showed growth. Over the week, Bitcoin gained more than 16%, setting a series of consecutive records. Institutional investors became active — BlackRock raised $1.12 billion in just one day of trading. The decentralized prediction platform Polymarket recorded a betting volume of about $3 million on the election outcome, with one user risking $20 million on Trump’s victory.

Election results in the USA. Source: Microsoft Bing

Regulatory changes on the horizon.

Robinhood’s chief legal officer, Dan Gallagher, is likely to become the new SEC chairman, which could significantly soften the regulator’s stance on cryptocurrencies. Senator Cynthia Lummis proposed creating a national reserve of 1 million bitcoins. At current prices, the program’s cost would be $76 billion, with funding planned to be achieved through the diversification of the Federal Reserve’s existing assets, totaling $7 trillion.

Trump effect: cryptocurrency funds reached a record $116 billion.

Donald Trump’s return to the political arena has sparked a surge of activity in the cryptocurrency industry. Major funds like BlackRock, Fidelity, and Grayscale continue to actively increase investment volumes, with the total amount of assets under their management reaching a historic high of $116 billion.

Last week, the funds attracted $1.98 billion — the largest inflow was in the US, with a figure of $1.95 billion. Bitcoin remains the leader in investments with $1.8 billion for the week, amid the growing popularity of spot ETFs. Ethereum also showed good results, attracting $157 million.

More to come: Trump promises to turn the country into a mining superpower, creating positive expectations among investors.

At the time of writing, Bitcoin has almost reached a new all-time high of $90,000.