Last Sunday, the main cryptocurrency surprised many, after updating the historical maximum and reaching $65,000, we anticipated a continuation of the upward dynamic and growth to $70,000-$75,000. But the big players had their own plans: impulse sales and the elimination of billions of dollars in long positions dropped the price to $51,000. What to expect next week in our weekly rate projection of Bitcoin to the dollar.

BTCUSD Forecast

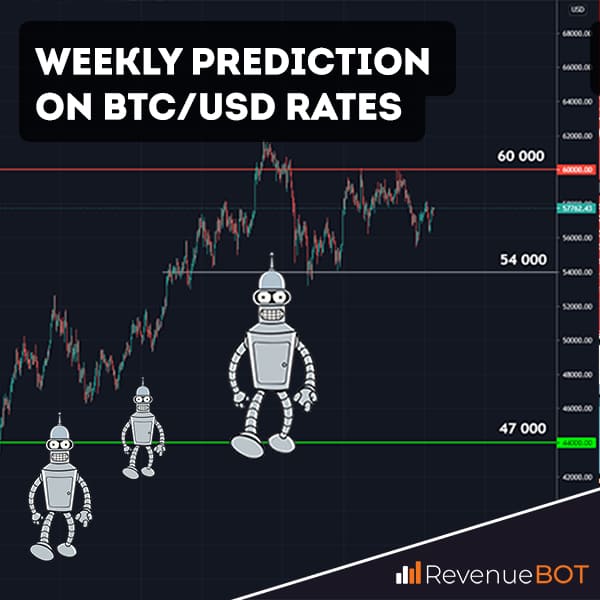

On Sunday morning, the Bitcoin collapsed from $60,000 to $51,000, where it found customer support. The main level of support was in the area of $54,000, where sellers significantly eased their pressure and Bitcoin was again in demand. Currently, the price is in the range of $57,000, suggesting a complete impulse reduction and stabilization of the situation. The main resistance so far is the $60,000 level from which the fall occurred. To return to the bull market, bitcoin needs to break above this zone, and then test the $64,000 level again. Only if the price overcomes the support level of both resistance levels, it will be possible to say exactly about the cancellation of a possible correction scenario, and even more so a fall.

If we look at the situation more broadly, we could predict this decline by looking at the divergence of growth dynamics with the RSI indicator. The relative power index has not updated the maximum since the beginning of the year, while the price has gradually set new records. The decline in customer strength hinted at an impulse correction, which, unfortunately, we did not care. Now, however, it is safe to say that once the pressure of buyers subsides, the market will move north again.

Our Bitcoin (BTCUSD) forecast for today, tomorrow, and the week of April 19-25 is a period of correction and price fluctuations in the range between $60,000 and $54,000. Only after the price overcomes the support level of $60,000, it will be possible to talk about the continuation of the upward dynamics.