The past week has been a nightmare for many individual traders and investors, who may have thought that the “winter” market had returned to the crypto market. However, as history has shown, the market is quite capable of adjusting by 20-30%, after which buyers regain power. Fundamental factors indicate that large investors are not going to leave the market, and some are just coming in. What to expect in this case in the coming week, we will analyze in our traditional weekly forecast of the bitcoin exchange rate to the dollar.

BTCUSD Forecast

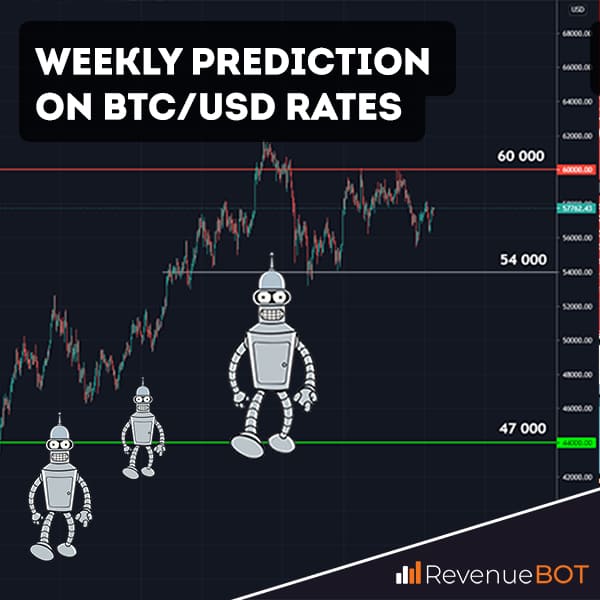

To date, the price of Bitcoin has recovered to $52,500, suggesting that buyers are gradually returning to the market. The good old strategy of “Buy the dip” has been working well in the market of cryptocurrency lately. The main area of support in the current correction became the $48,000 level, from which the price has already been reversed twice in recent days. The nearest resistance zone and the first barrier to completion of the correction is the $54,000 level. The price increase at this level would be a tipping point, but to complete the correction would require overcoming the main resistance in the $60,000 area. It was from this zone that the impulse sales began, where the bulk of liquidity, including sellers, was now concentrated.

The relative strength index of the RSI indicator indicates that the sellers have finished what they started and driven the price to the oversold zone. Yes, the potential for further decline still remains, but if it will be, it is extremely insignificant. For example, a $48,000 retest attempt followed by impulse purchases. In short, the most likely return is now $54,000, followed by a $60,000 test, from which impulse sales started and where the main liquidity pool is currently concentrated.

Our forecast for Bitcoin (BTCUSD) for today, tomorrow and the week of April 26 to May 2 is the completion of the correction and an attempt to return to $54,000 and then to $60,000. Only by raising the price of $60,000 will the correction be complete.