There is the following theory: at a time when cryptocurrencies are becoming more expensive, the industry as a whole is developing. In connection with this theory, some crypto enthusiasts distinguish several cycles of the cryptomarket, and now we can observe one of them. In this article we will discuss it in detail.

As a rule, when the value of cryptocurrencies increases, the media, forums start talking about them, and thematic groups are created in social networks. All this gives the effect that cryptocurrencies are beginning to be interested in those who previously knew nothing about them or those who simply did not pay attention to them. Both options bring new faces to the crypto industry and, as a result, new projects as well as investment.

It works with any new direction, whether it’s cryptocurrency or a revolutionary branch of pharmacology. The more they say it, the faster it develops.

In the crypto industry, it works 100%. Market participants have long noted that the more they talk about digital assets on the web, the faster their value increases.

In 2021, four main cycles of the crypto market can be distinguished:

- 2009-2012.

- 2012-2016.

- 2016-2019.

- End of 2020 – ?

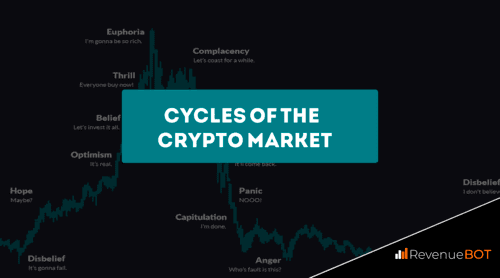

As a rule, in the market at this moment, you can observe a “native”, that is, the value of cryptocurrencies is growing so fast that it does not fit into your head. The next crypto cycle is determined by the following factors:

- The value of all cryptocurrencies begins to grow;

- Cryptocurrencies are actively discussed by the media, forums, and social networks;

- After that, new ideas come to the market. At this point, the price of digital assets goes to correction;

- New ideas are then translated into projects and start-ups;

- These projects go through a formative period and trigger a crypto market for the next growth that will trigger a new cycle.

The situation is that the end of each cycle triggers the start of a new cycle. Now, let’s talk about each crypto cycle separately.

1 cycle 2009-2012

The first cycle is usually counted from the moment bitcoin was created. In the network it is often called a gene block, because there were no blocks before it. The cryptocurrency was developed from scratch by Satoshi Nakamoto, the creator of Bitcoin. A couple of years later, the first crypto startups could be seen. The legendary Mt.Gox Exchange was the first place where bitcoin was traded. This benefited the main cryptocurrency: the price rose from $1 to $31. As expected, everyone started talking about Bitcoin: ordinary people and top-rankers from Wall Street, media, forums. It is worth noting here that even committed crypto enthusiasts treated Bitcoin as an experiment. They could not have imagined that its value could approach the value of the shares of traditional companies and could eventually change the financial system altogether. According to the crypto stages of the cycle, a little more than a year later Bitcoin began to get cheaper, and talk about it stopped. However, the industry began to attract people who brought ideas, perhaps not new ones, but given that the market was not busy, they worked. Among the main ones, we can distinguish that in 2011 Litecoin and Namecoin appeared, the first crypto wallets and mining pools appeared. Also, in 2011, Vitalik Buterin became the co-founder of Bitcoin Magazine.

2 cycle 2012-2016

By the end of 2012, the price of Bitcoin had begun to rise. This trend continued at the end of 2013: on December 2, the main cryptocurrency updated its historical maximum of $972. This growth meant the start of a new cycle, because cryptocurrencies were being talked about again by people, because it was hard not to notice the impulse growth. True, there was one significant difference with the first cycle: if then only those who understood what they were talking about (technologists, programmers, financiers, cryptologists) paid attention to cryptocurrencies, now everyone has started talking about them. Ordinary people were interested in rapidly increasing their savings, although they did not understand cryptocurrency and blockchain. Thus, the influx of new persons in the second cycle was 10 times greater than in the first.

It is possible to say that this cycle has given life to the crypto industry because in its time the following projects were launched: Ethereum, Monero, Ripple and Dash. These cryptocurrencies are still in demand, ETH and XRP are in the top 10 in capitalization. Ethereum has a number of crypto projects on its blockchain, as it is considered the most important decentralized site using smart contracts.

In 2016, the price of Bitcoin did not show such an increase, and at the end of the year the correction began.

3 cycle 2016-2019

This cycle is remembered by the entire crypto industry and can rightly be called the most significant. ICO, the primary public placement of tokens, appeared during the third cycle. Although the first ICO was held in 2013, it was not widely used until 2016. That’s when the fundraiser for a lot of crypto projects started. Most likely, you do not need to be reminded that the scammers among these projects were half, if not more. Therefore, many ICO investors simply did not get their funds back. For this reason, we do not see any activity in the ICO right now: who would want to contact the alleged scammers?

In any case, there were also those projects that honestly spent the funds received for development, so during the third cycle, even more crypto companies appeared than in the previous two. As for bitcoin, it began to be bought up en masse. By the way, in 2017, for the first time, the guys from Wall Street were suspected of fraud in the crypto market. At the beginning of the year, market capitalization was only $19 billion, and given the amount of money available in traditional markets, it was not that hard to manipulate the price. Moreover, the crypto market is unregulated, so there will be no criminal penalties.

By the end of 2017, Bitcoin had updated its historical maximum to $20,000. Soon after this began the «crypto-winter»: the capitalization of the crypto market decreased from $800 billion to $200 billion, and in the price of all cryptocurrencies the long downward trend prevailed.

4 cycle 2020 -?

So we’ve reached our time. The fourth cycle starts in November 2020. A few months earlier, the price of Bitcoin had also been rising, but not as fast as it had been at the end of the year.

Just think: On December 11, 2020, Bitcoin cost $17,800, and on April 14, 2021, it updated the historical maximum of $64,600. In percentage terms, this growth is much lower than in previous cycles. But if you look at bitcoin in absolute terms, there is no more expensive asset on the financial market.

Here, as in previous cycles, the price of Bitcoin started to spike, so it began to be said everywhere. It is worth noting that we have seen a historic event in the crypto industry: institutional investors have started investing in cryptocurrency. It was a different kind of money that drove Bitcoin to this size.

In addition, traditional financial companies that provide services around the world have either already implemented cryptocurrency or are actively working on it. Their list includes: Visa, MasterCard, PayPal, JP Morgan, Tesla, Citigroup and others. The world has also begun work on government cryptocurrencies.

Although DeFi and NFT are not new areas in the crypto industry, they have only been active since the beginning of the fourth cycle. Many projects have emerged that identify themselves as part of the sector’s new directions.

As a result, the crypto industry now has tremendous support from the traditional financial sector. So the question is, if you look at the previous cycles, the growth of the crypto market continued for a year and a half, with a cycle length of 3-4 years. But back then, there were no institutional investors in the market, and cryptocurrency didn’t start to enter normal life processes. How long can growth last now?

It is safe to say that the growth will be until the end of 2021, because there are no factors that say the opposite now. In order not to miss the opportunity to earn money, use the services of RevenueBot. The service offers the creation of trading bots for trading on top crypto platforms. You can learn more about RevenueBot on the official website of the service.