As of today, the cryptoverse is a unique environment where investors not only enjoy the opportunity to invest in digital assets, but they also seek to profit from their volatility. For those just starting out in this ever-dynamic environment, the terminology may appear complex and perplexing. Taking either long or short positions is one of the key aspects in crypto trading strategies.

Let’s face this monster together – we suggest you to figure out what long and short positions mean and how to properly utilize these principles to achieve your financial goals.

The concept of long and short positions

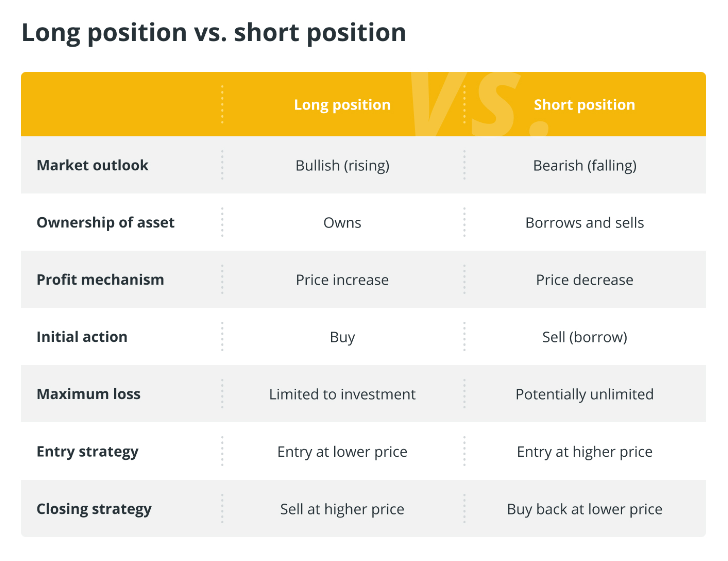

Speaking of long positions, these are a basic investing strategy where an investor buys an asset aniticipating further rise in value. In the context of crypto, long-term growth outlooks often incentivize investors to enter into long deals. This means that an investor purchases a digital asset, such as Bitcoin or Ethereum, knowingly with the expectation that its value will increase over time.

The basic idea behind long positions is to benefit from future price movements of any given asset. What the investor believes in is the upside potential of the asset and is willing to hold the asset for a longer period of time to maximize their returns. However, such an approach is also risk-bearing, as the crypto market is notorious for its high volatility.

Short positions constitute a strategy that is completely different from conventional investing. While trading, an investor entering a short deal foresees a decline in the asset’s value.

The point of short positions is to make money on dropping prices. If you accurately predict a downward trend in value, you can close your position profitably and make a gain from the margin. However, this strategy is not entirely risk-free as the market can be exposed to abrupt changes.

Understanding both long and short positions allows traders to manage their portfolio more effectively, as well as utilize a variety of strategies in different market conditions.

How to go long?

Going long requires careful planning and perfoming steps as follows:

- Analyze the market: do a little research on the crypto market and choose the desired assets before you embark on trading. Analyze the fundamental and technical aspects as well as the specifics of each chosen asset.

- Determine the time frame: decide on the duration for which you plan to hold your long position. Long-term investors tend to focus on growth prospects over the coming months or even years.

- Choose the suitable exchange: define the CEX where you wish to open your position. Make sure that the exchange supports your assets.

- Create a trading account: sign up and pass the verification procedure. Do check that you fully understand the platform’s terms and conditions .

- Buy the digital asset: transfer the necessary funds to your newly-made account. While on the exchange, select the Long option for the selected asset and specify the desired purchase amount.

- Set Stop-Loss and Take-Profit: for the sake of risk management, determine the point where you would close your position with a possible loss as well as assess the profit level where you would like to lock in profits.

- Conduct monitoring and make corrections: keep track of changes in the market on a regular basis, refresh your strategies and adjust your position if necessary.

Once you follow these steps and acquire a thorough understanding of the crypto market, you will be able to open a long position according to your own investment objectives and risks.

How to go short?

It actually doesn’t matter much whether you go short or long. Anyway, you need to analyze the market, decide on the time of opening either position, pick the relevant crypto exchange, set Take-Profit and Stop-Loss and carry on monitoring the trends.

The only major difference is that instead of buying the asset hoping for its growth, the trader rather anticipates that the asset price will slide.

They do so by borrowing crypto from an exchange or another user. Once the asset is borrowed, it is sold in the market. Now you went short, and your profit will be based on the spread between the price when you sold the asset and the price when you close the position.

Keep in mind that going either short or long is a strategic approach to the cryptomarket that requires proper scrutiny and a solid awareness of the associated risks.

Conclusion

In the world of crypto, where digital assets are subject to constant fluctuations, awareness and utilization of long and short positions becomes a key factor for successful trading. Long positions provide investors with the opportunity to invest in assets expecting them to rise, while short ones pave the way for investors to generate profit from declining prices.

Notably, trading crypto is not devoid of risk, and winning strategies require rigorous analysis, planning, and risk management. Investors must be mindful of their financial goals and time horizons.

Whether you choose to go long or short, the key element remains learning and constantly staying up-to-date in the crypto environment. Be aware that the digital gold market offers unique opportunities, and mastering the skill of trading via long and short positions can serve as an effective tool to meet your aspirations.