In the era of digitalization where cryptocurrencies are gaining ground in the financial world, the issues surrounding both crypto trading and crypto investing are becoming more and more of a concern. These two terms are often used interchangeably, but as it turns out, there are substantial distinctions that define strategies and approaches to dealing with decentralized assets.

In this article, we will look into each of the two terms and try to figure out what their key differences are.

What exactly is crypto trading?

The process of trading cryptocurrency portrays a fast-paced world where digital assets are being exchanged in the financial markets. Unlike conventional trading which is conducted at exchanges and markets using fiat money, crypto trading is rather performed using decentralized digital assets such as Bitcoin, Ethereum, and various altcoins, among others.

CEXs, acting as virtual marketplaces, empower traders to buy and sell digital assets in real time. They open up unique opportunities for traders, allowing them to interact with global markets around-the-clock, from anywhere in the world.

Cryptocurrency trading implies that you use a variety of strategies, including day trading, position trading, scalping, and arbitrage. Additionally, a vital part of crypto trading involves analyzing the market and charts, assisting traders in making informed decisions amidst its high volatility.

Pros and cons of crypto trading

This type of trading offers one-of-a-kind possibilities and risks that are important to consider when opting to enter this brave new world.

Pros:

- High volatility: the non-stopping price fluctuation lets traders leverage plenty of lucrative trading opportunities, especially when using the proper strategies.

- 24/7 access: the crypto market is available for trading non-stop, enabling traders to flexibly adapt to their schedule and time zone.

- Low fees: some CEXs can boast significantly lower transaction fees compared to traditional financial markets.

- Decentralization: the absence of centralized control ensures that market players can avoid the influence of state institutions.

Cons:

- Poor risk: due to market volatility, cryptocurrencies can be subject to significant price movements over a short period of time, increasing the risk of capital loss.

- No regulation: the never-controlled nature of the crypto market can pave the way for fraud and unscrupulous activity.

- Technical challenge: traders should be aware of how to use crypto wallets, key security, and other aspects of crypto trading.

- Limited adoption: as of now, barely all countries and companies embrace crypto, which can limit how they can be used in everyday life.

What is crypto investing then?

This one is a strategy of participating in a ever-growing digital market for long-term capital gains. That’s a process that differs from short-term crypto trading and involves holding assets for a solid period of time.

Peculiarities of investing in crypto:

- Choosing the desired portfolio: investors can pick from a wide array of digital assets, such as BTC, ETH, among others. Diversifying your portfolio can help mitigate risk and multiply potential rewards.

- Long-term outlook: the core idea behind investing in cryptocurrency is to hold assets for a longer period of time, ignoring short-term price swings.

- Asset storage security: you should ensure that your assets are safely stored within wallets and by other secure techniques.

- DYOR (Do Your Own Research): before investing in a particular coin, a thorough research on the projects, their fundamental characteristics and prospects is important.

- Global trends and regulatory amendments: you have to stay up to date with global trends going on in the cryptoverse and keep up with possible regulatory changes that may somehow affect the market.

Investing in crypto requires patience, strategic thinking and a profound understanding of the long-term shifts in the market.

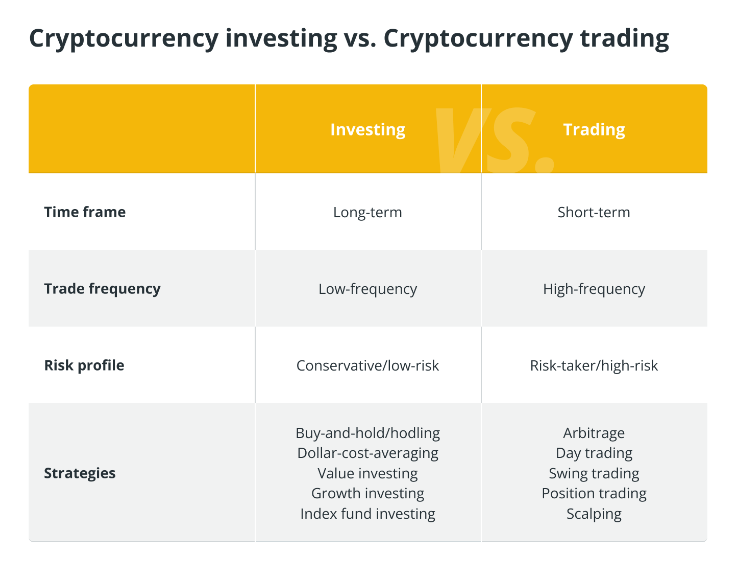

So what are the key differences between crypto investing and crypto trading?

Both processes represent two different approaches to dealing with digital gold, each with different features and purposes.

Speaking of investing, here we are rather focused on holding digital assets for the prolonged period of time in order to generate income in the long run.

But crypto trading is a far more active and short-term approach, aiming to profit from short-term price fluctuations.

What is important to realize is that both approaches have their benefits and drawbacks, and the choice between investing and trading depends on your goals, time horizon, and risk tolerance.

Conclusion

In today’s world, cryptocurrencies represent a unique asset class that catches the eye of investors and traders alike.

Investors seeking sustainable growth prefer long-term investing based on fundamental analysis of projects and portfolio diversification. Traders are rather focused on instantaneous changes in market conditions, they prefer trading based solely on technical analysis, active trading and risk management strategies.

Despite their differences, the two strategies complement each other, providing investors and traders with flexible tools to achieve their financial goals successfully. Each market player here is free to choose an approach that fits them, actually.