Nowadays, cryptocurrencies constitute an essential element of the financial ecosystem, offering one-of-a-kind opportunities for their users. Using multisig wallets is indeed a key tool for securing and controlling your crypto assets. Not only does this technology enhance security, but it also ensures greater flexibility and transparency when it comes to handling the funds. In this article, we will break down what multisignature wallets really are and why those are becoming an integral part of today’s world.

To begin with, what is a crypto wallet?

A crypto wallet is basically a place where you store, manage, and carry out transactions with cryptocurrencies. It is a digital equivalent of the purse we use to store paper (fiat) money, except that this one is designed to handle digital assets.

A key function of any crypto wallet is to securely store the private keys needed to access your funds. As for private keys, these are used to sign transactions, verifying ownership of assets and thus keeping your portfolio secure.

There exist several types of cryptocurrency wallets – hardware wallets and software ones, the latter of which includes online wallets, mobile wallets, and desktop wallets. Each has its own features and benefits, providing users with a wide array of options for managing their digital funds.

What a cryptocurrency wallet is all about is not only the storage of assets, but also the usability and safety of transactions conducted in our digital realm.

How does a multisig wallet work?

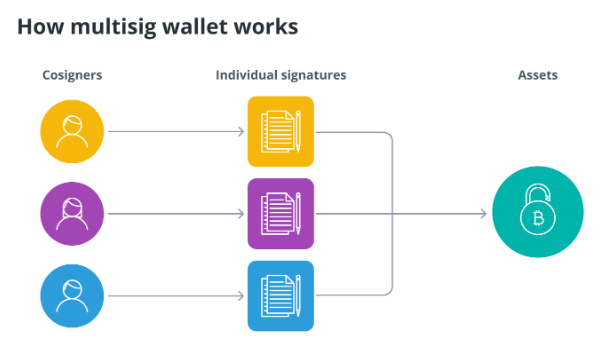

A multisig wallet is a solution designed to advance financial security and asset management. Unlike traditional wallets that require just one signature to complete a transaction, a multi-signature wallet uses multiple keys to validate it. Let’s take a look at how exactly this works.

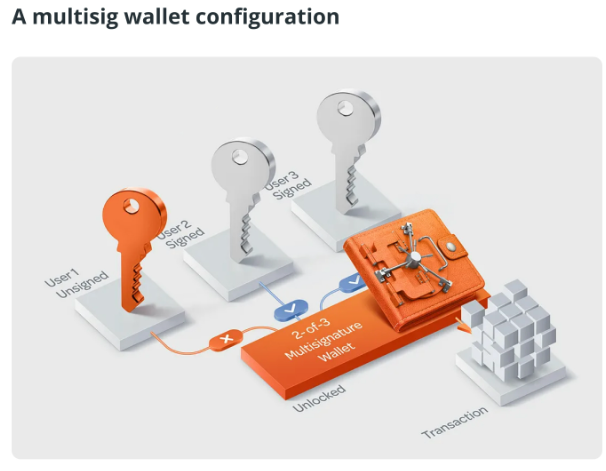

- Creating multiple signatures. When you create such a wallet, you are able to define the number of keys (signatures) required for the transaction. A 2-of-3 setup, for example, would require two of the three pre-defined private keys to be signed in order to complete the transaction.

- Participating of multiple people at the same time. Each of the individuals involved in a multisig wallet can hold their own private key and do it on their own device as well. This allows for security patterns where multiple independent parties are required for a transaction to complete.

- Confirming transactions. For a transaction to be performed, it is imperative to achieve the consent of a certain number of keys set when creating the wallet. Once the requisite number of signatures has been reached, the transaction is considered valid.

- Advantages

High security: multisignature wallets provide an extra layer of security as multiple private keys are necessary to approve a transaction.

Absolute control: this type of wallet usually means that users have more power and control over their assets, allowing them to delegate the management of assets to different parties.

Error prevention: multisig wallets are also a remedy for preventing accidental or malicious transactions.

- Actual use Multisignature wallets are widely adopted in corporate environments, family wealth management where a more sophisticated and secure mechanism for managing crypto assets is needed.

How to set up a multisignature wallet?

Setting up a such a wallet is a crucial step to ensure both security and flexibility in managing your digital funds. Here’s what you should do to set it all up:

- Step 1: Choose a suitable option Pick such a crypto wallet which supports the multiple signatures feature. Some well-known multisig wallets include Electrum, Armory, and Copay.

- Step 2: Create a wallet. Follow the guidelines of the selected wallet to create it. Make sure you select the Multisig option if one is provided.

- Step 3: Enter the desired number of private keys to be used. Specify how many signatures will be required for each transaction. The private keys can be shared between different participants.

- Step 4: Distribute the private keys between your co-signers. When assigning private keys, keep in mind that each of them should be in trustworthy hands. It may involve storing keys on multiple devices or sharing them with different individuals so as to maximize security.

- Step 5: Create a new smart contract. Most multisignature wallets require the generation of a smart contract that defines the terms and conditions for transactions. Check that you have properly configured the smart contract according to the selected signature and private key settings.

- Step 6: Create a backup. Have all private keys and wallet setup info backed up. Doing so is important to avoid losing access to assets if the device is damaged or keys are lost.

- Step 7: You are all set! Now that the wallet is set up, you’re ready to manage your crypto assets with the highest level of security and control provided by the multisig feature. Bear in mind to update your backups regularly and store your private keys carefully to maintain the soundness of your wallet.

Conclusion

Multisignature wallets introduce a new level of privacy and control in the cryptoverse. These tools allow users to split asset management across multiple users, creating additional roadblocks to potential exploits and errors.

These wallets have seen widespread use in the corporate sector, family wealth management and other areas that demand a high level of security. At the same time, they open up new opportunities for reliable and versatile management of crypto assets.