Crypto industry experts are deeply concerned about the upcoming BTC halving as well as about its recent teasing to hit ATH. With eacg new price rally, those who want to make a profit here and now are returning to market (if past experience is anything to go by). It’s not necessarily about investing in blue-chip cryptos, such as memecoins, but some prefer to obtain them through mining.

Is Bitcoin mining profitable in 2024?

With each new halving procedure, individual miners are finding it more challenging to mine bitcoin. Bitcoin mining, in fact, is the solution of complex mathematical equations, by way of computing power. The more computational resources you have, the more likely you are to receive a reward – in the form of BTC itself. However, such phenomenon as a single person being paid to create a block used to be very rare in the past, and now it doesn’t exist at all. The reward is typically split between several miners, depending on who is involved in the mining and how much capacity they have utilized.

And now you might ask: how is it possible for a small mining farm installed in one’s apartment, country house or office to outperform the huge warehouses with mining rigs? Well, it isn’t. This suggests that the lower the reward for generating new blocks in the Bitcoin network is, the less decentralized it becomes. Privately-owned mining companies can use their facilities to mine other cryptocurrencies, since in the case of Bitcoin, getting a decent reward so as to cover the electricity and equipment costs alone is unachievable.

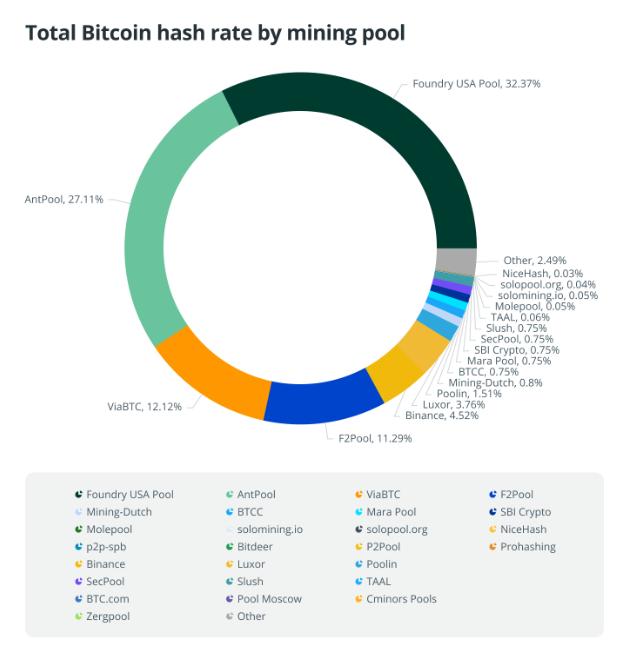

Historical data gleaned from btc.com indicates that between 2016 and 2021, on any given three-day period, the top two mining pools controlled around 30–40% of the hash rate.

Hashing power is far more centralized lately. On Feb. 28, two leading mining pools, Foundry USA and AntPool, regulated almost 50% of the network’s hashing power, according to Coin Dance.

Data from mempool.space shows that 26.55% of the total blocks have been mined by anonymous or unaffiliated sources since Bitcoin’s inception. Mining pools, such as F2Pool, mined 10.11% of all blocks over that period, while AntPool mined 10.02%.

In the last three years, however, the abovementioned Foundry USA mined 21.55% of all blocks, AntPool mined 18.78%, whereas F2Pool mined only 14.25%.

Over the past three months, the centralization has surged, with Foundry USA mining 30.32%, AntPool mining 26.03%, ViaBTC mining 12.52% and F2Pool mining 11.94%.

Centralized mining issue

The halving will lead to hash rate volatility, as miners facing higher operating costs and outdated setups will go offline. This will further centralize hash rate, with large-scale mining pools operating with significantly lower marginal cost per hash rate — thus intensifying centralization concerns.

To put it otherwise, once bitcoin halving takes place, miners lacking processing capacity are to stop supporting the network, therefore BTC transaction fees may climb for a moment. Nonetheless, their spots will soon be taken by the mining pools mentioned above. Fee rates are going to flatline, but also decentralization will once again loom less often.

The excessive centralization of the Bitcoin network entails two main implications:

- First, with significant control over the mining process, centralized entities might have the undue power to censor transactions by choosing not to confirm them, which conflicts with Bitcoin’s ethos of decentralization and censorship resistance.

- Second, centralized mining pools could exert disproportionate influence over decisions regarding Bitcoin’s protocol updates or changes, potentially skewing development in favor of their interests rather than the broader community.

Bitcoin researcher Chris Blerc. Back in December 2023, Blerc posted on X the opinion that AntPool and Foundry USA controlled 55% of the hashing power. These top two mining pools are both regulatory compliant and require all miners to fulfill Know Your Customer (KYC) obligations — ostensibly placing control over the transactions details in the hands of U.S. regulators.

A bit earlier, in November 2023, Bitcoin Core tracing framework developer 0xB10C reported on a number of transactions that may have been filtered out of blocks by mining pools. The suspect blocks all contained addresses sanctioned by the United States Office of Foreign Assets Control (OFAC).

Out of 6 candidate blocks, 0xB10C identified 4 blocks believed to omit OFAC-curbed addresses.

All four transactions were ignored by the F2Pool mining block. 0xB10C ultimately said, “These four missing sanctioned transactions lead to the conclusion that F2Pool is currently filtering transactions.”

That opinion was vindicated in short order as F2Pool confirmed that it had filtered transactions. Following community pushback, it then announced it would reverse the decision “for now.”

Keep in mind that even if one mining pool filters out a transaction, that does not stop the transaction from being processed, but it does potentially result in that transaction taking longer to process. The more mining pools that filter it, the longer the potential delay.

Conclusion

So the thing is that every halving brings BTC closer to imminent centralization. There have been precedents for transaction filtering, so no need to think there’s any way around it. Cryptocurrencies are slowly but surely becoming common assets, neither granting any anonymity nor freedom to transfer funds anywhere on the globe. Indeed, at this point things are far from real, but with each passing year we are creeping closer to a total lack of privacy and independence.