The RevenueBot team has done a tremendous job on the built-in indicators, carefully re-verifying all calculations. We can now confidently say that our indicators display the same values as Binance, Bybit, TradingView, and others.

Today, we’ll delve into the Stochastic indicator in more detail, explaining what it displays and how to use it.

The Stochastic indicator is an oscillator that helps identify turning points and trend changes.

It consists of two lines: the fast %K and the slow %D. We use the Stochastic settings (14, 3, 3). The indicator values range from 0 to 100:

- Values below 20 indicate the oversold zone and signal a potential buy.

- Values above 80 indicate the overbought zone and signal a potential sell.

RevenueBot calculates both the standard Stochastic indicator (Stochastic LONG1 and Stochastic SHORT1 crossing lines) and our own Stochastic indicator strategies that provide more accurate trade entries. We’ll cover these in more detail below.

Strategies using the Stochastic Indicator:

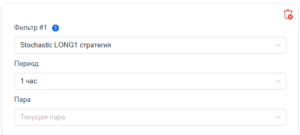

- Stochastic LONG1: Triggers if the %K line crosses the %D line from below.

- Stochastic SHORT1: Triggers if the %K line crosses the %D line from above.

To enable this filter, select it and set its analysis time period.

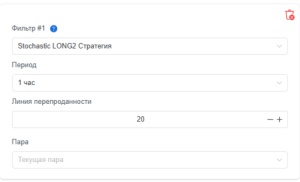

- Stochastic LONG2: Triggers if the %K and %D lines cross the value X from below (default X = 20). There is an additional setting to set your own value.

- Stochastic SHORT2: Triggers if the %K and %D lines cross the value X from above (default X = 80). There is an additional setting to set your own value.

To enable this filter, select it and set its analysis time period. You can also change the oversold line value that the indicator lines need to cross.

Now let’s talk about Stochastic LONG3 and Stochastic SHORT3. The RevenueBot team has created unique calculations where the crossover must occur below a certain line, making this filter truly unique. This allows for accurate market turn identification and helps our users maximize profits.

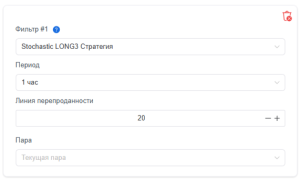

- Stochastic LONG3: Triggers if the %K line crosses the %D line from below and both lines are below X (default X = 20). There is an additional setting to set your own value.

- Stochastic SHORT3: Triggers if the %K line crosses the %D line from above and both lines are above X (default X = 80). There is an additional setting to set your own value.

To enable this filter, select it and set its analysis time period. You can also change the oversold line value that the indicator lines need to cross below (for the Long algorithm) or above (for the Short algorithm).

Wishing you successful and smooth trading!