Content:

- Opening an account on FTX.com

- Adding funds to the exchange’s account FTX.com

- Creating an API key on FTX.com

- Adding an API Key FTX.com in RevenueBot

- Creating a bot for FTX.com perpetual cryptocurrency futures.

- Recommendations for trading on FTX.com

- General recommendations for trading Cryptocurrency futures using leverage

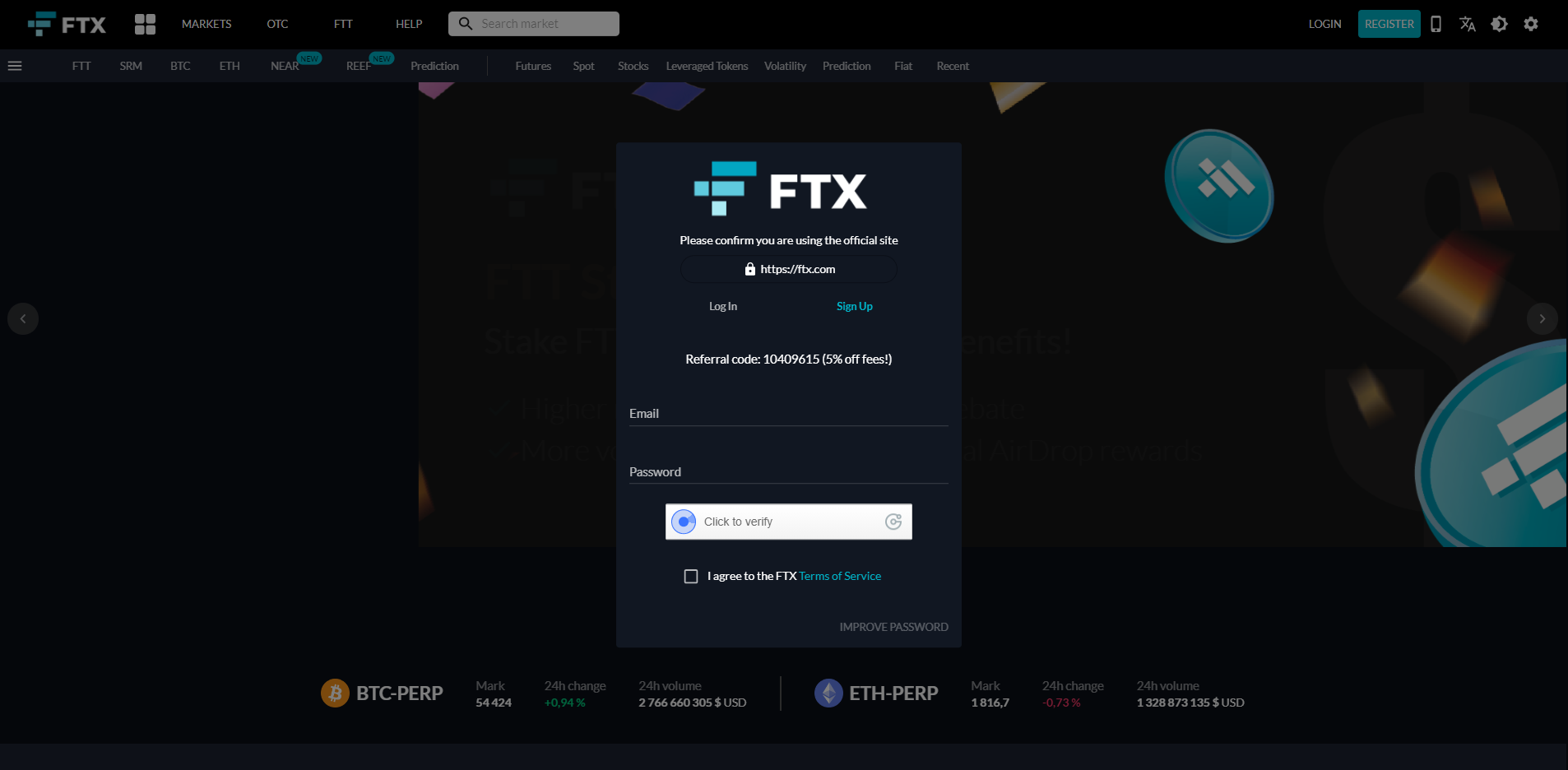

1. Opening an account on the exchange FTX.com

You need to go to the exchange’s website and register. We would appreciate it if you could use our referral link: https://ftx.com/#a=10409615.

After you go to the exchange site click «Registration», in the top right corner, fill in the necessary fields and confirm the account from the letter that will come to e-mail.

In this article we consider trading only perpetual futures, a list of which can be seen here, or when choosing a trading pair when creating a bot.

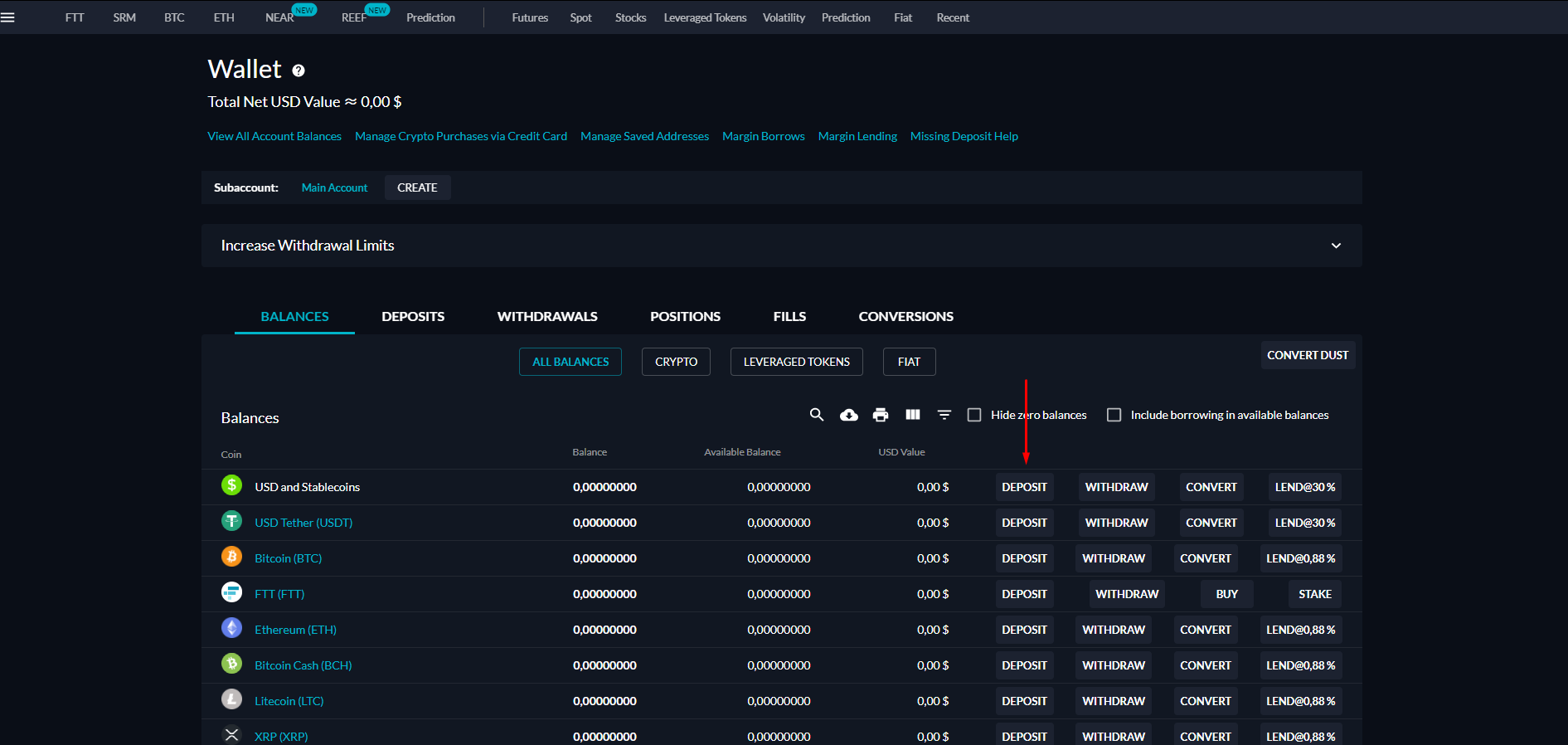

2. Adding funds to the exchange’s account FTX.com

You can top up the exchange’s wallet by clicking on the link, then click on “Deposit”.

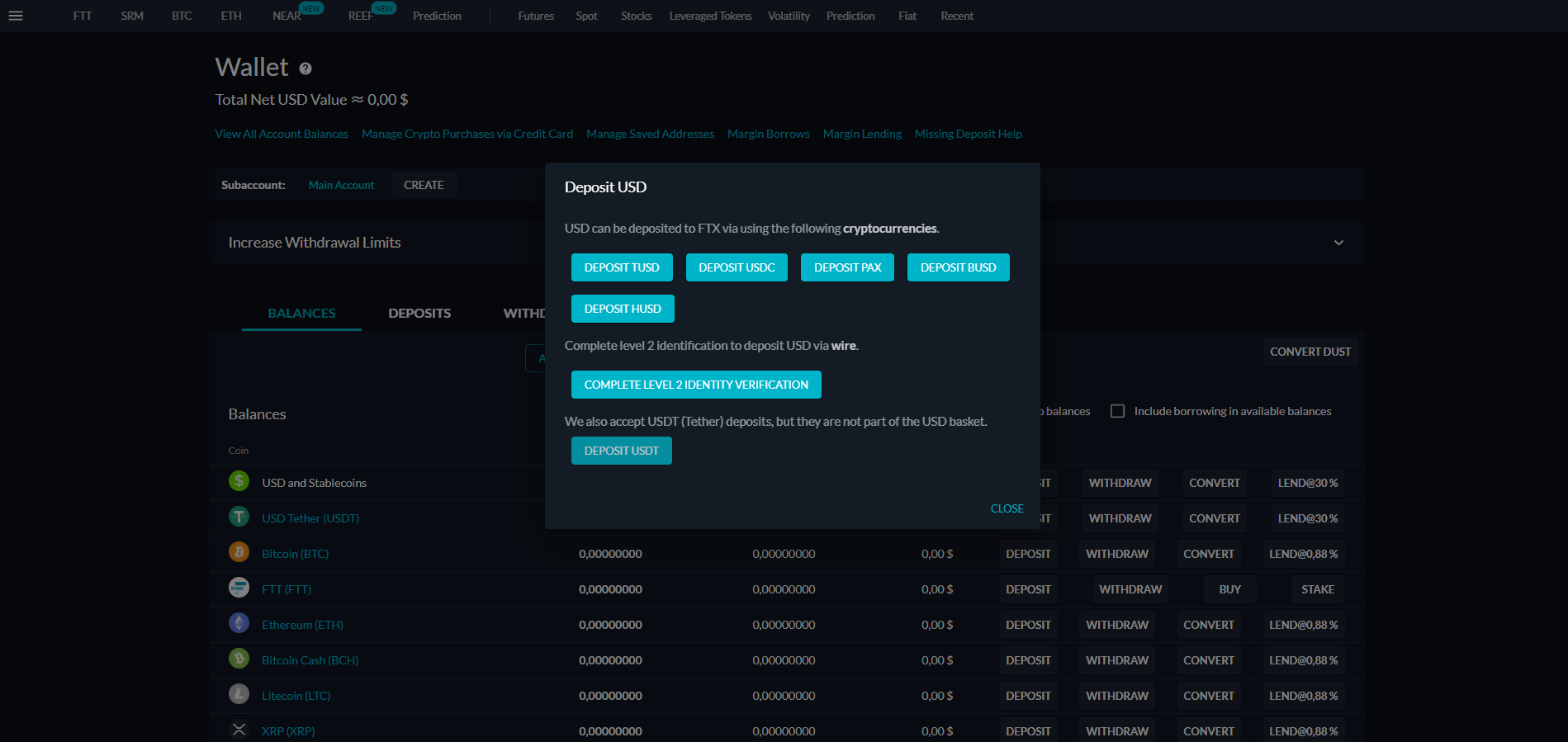

Depending on which cryptocurrency you want to add to your account, different windows will be opened. On the FTX Exchange, futures trading goes to USD. If you click on «Deposit» opposite USD and Stablecoin, the following window will open before you:

The amount of all stablecoins in the Exchange’s purse is the total USD basket. Note that in USDT you can replenish the purse of the exchange, but USDT will not be part of the USD basket. This means that you have to use other stablecoins to replenish the purse of the FTX exchange, to trade futures. At the time of writing, it is TUSD, USDC, PAX, BUSD, HUSD.

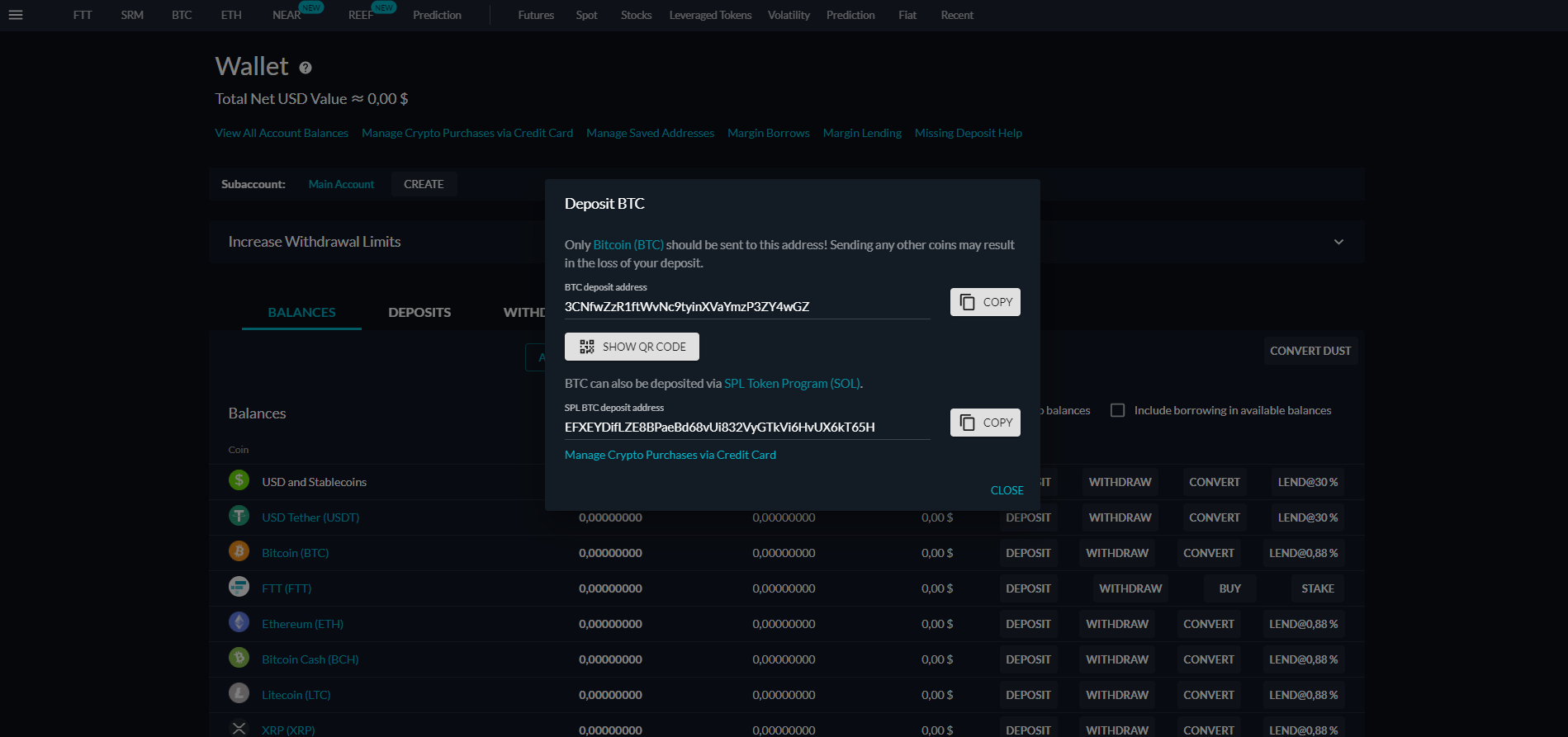

If you choose to top up an account, for example in BTC, the following window will open:

The account can be filled by different cryptocurrencies (their detailed list is given here). After that you can use the function «Converting» and exchange your cryptocurrency for the right stablecoin. This also applies to fiat currencies.

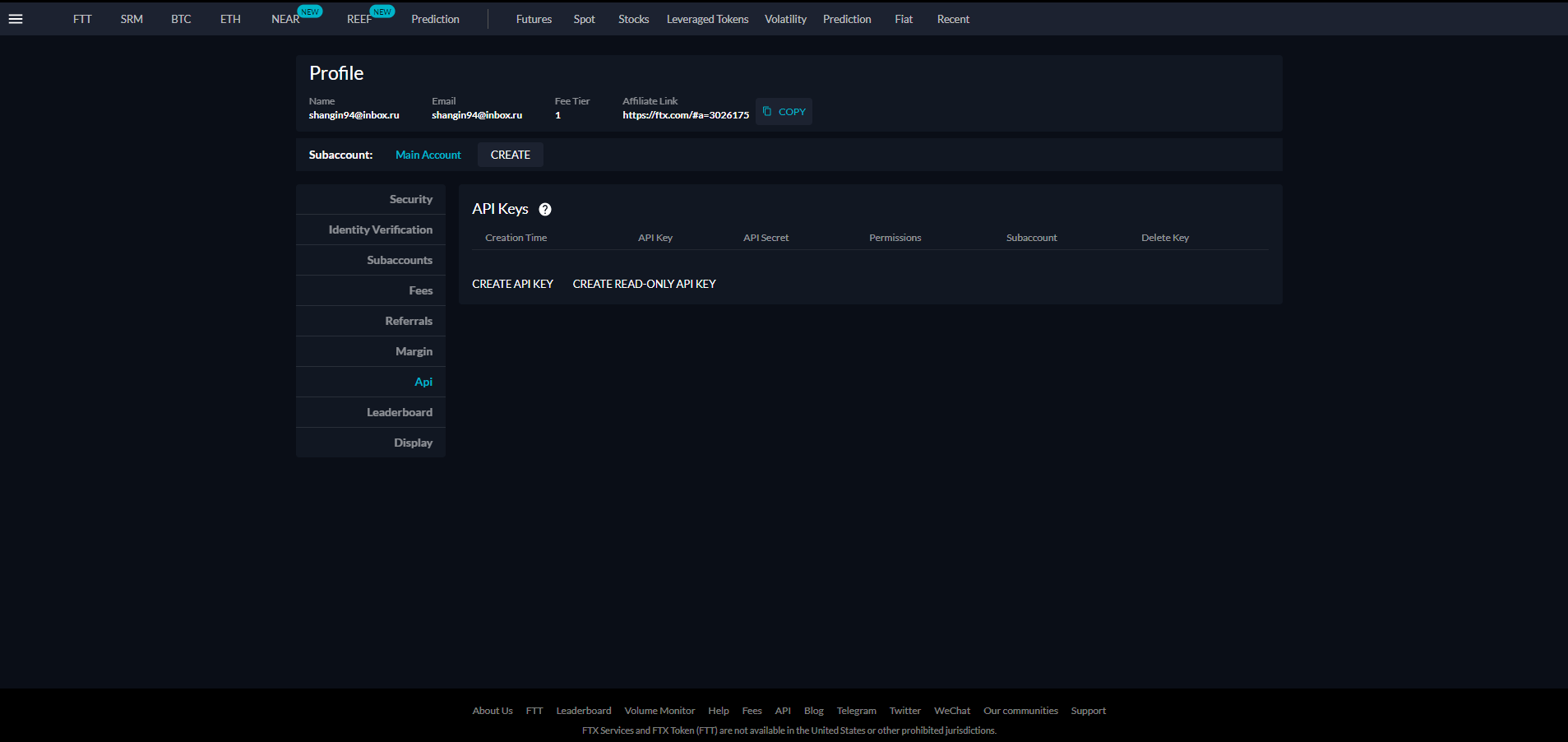

3. Creating an API key on FTX.com

To create an API key on the FTX exchange you need to go by the link. You will see all sorts of settings for your account.

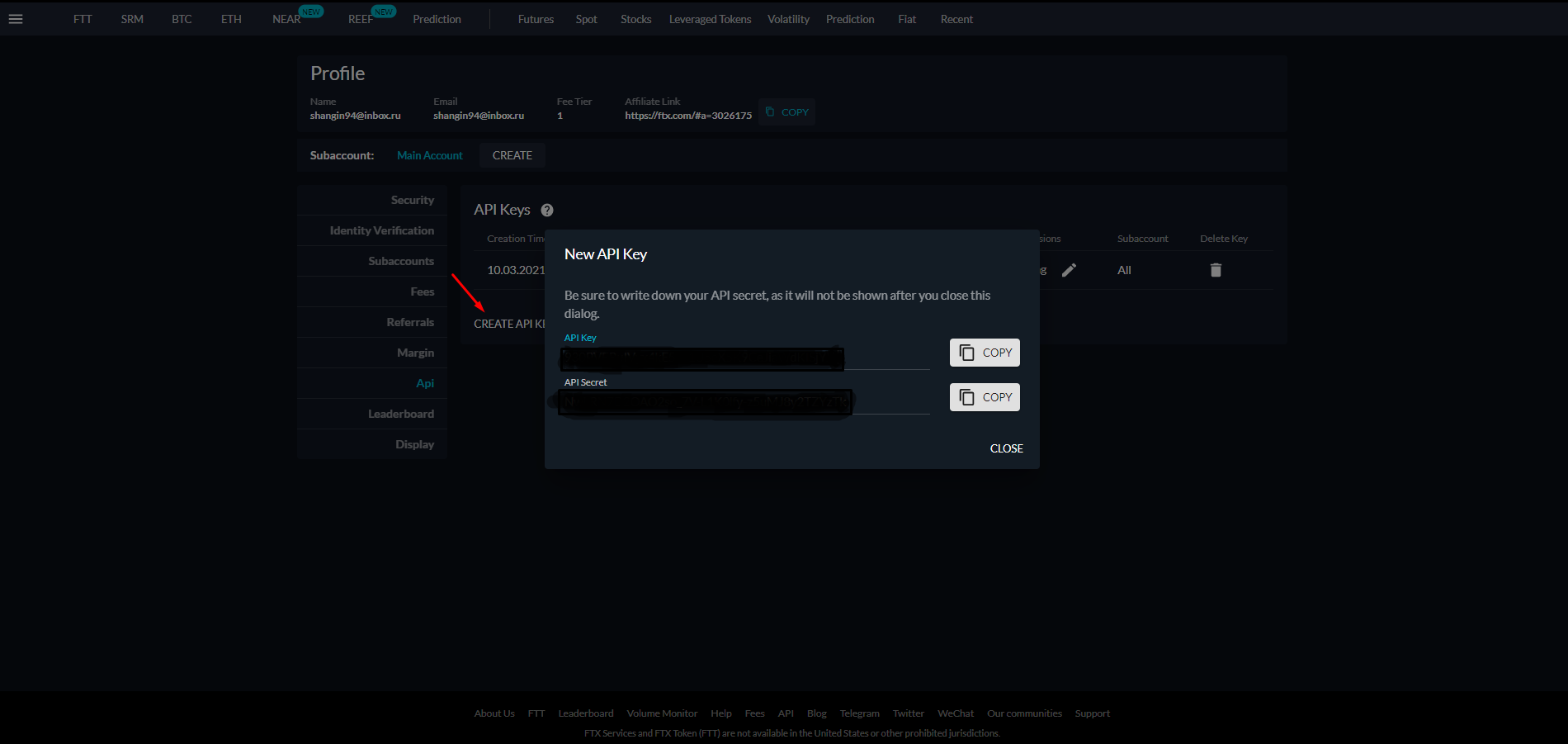

Click on «Create API key». The system will display the key itself and the secret part of the key.

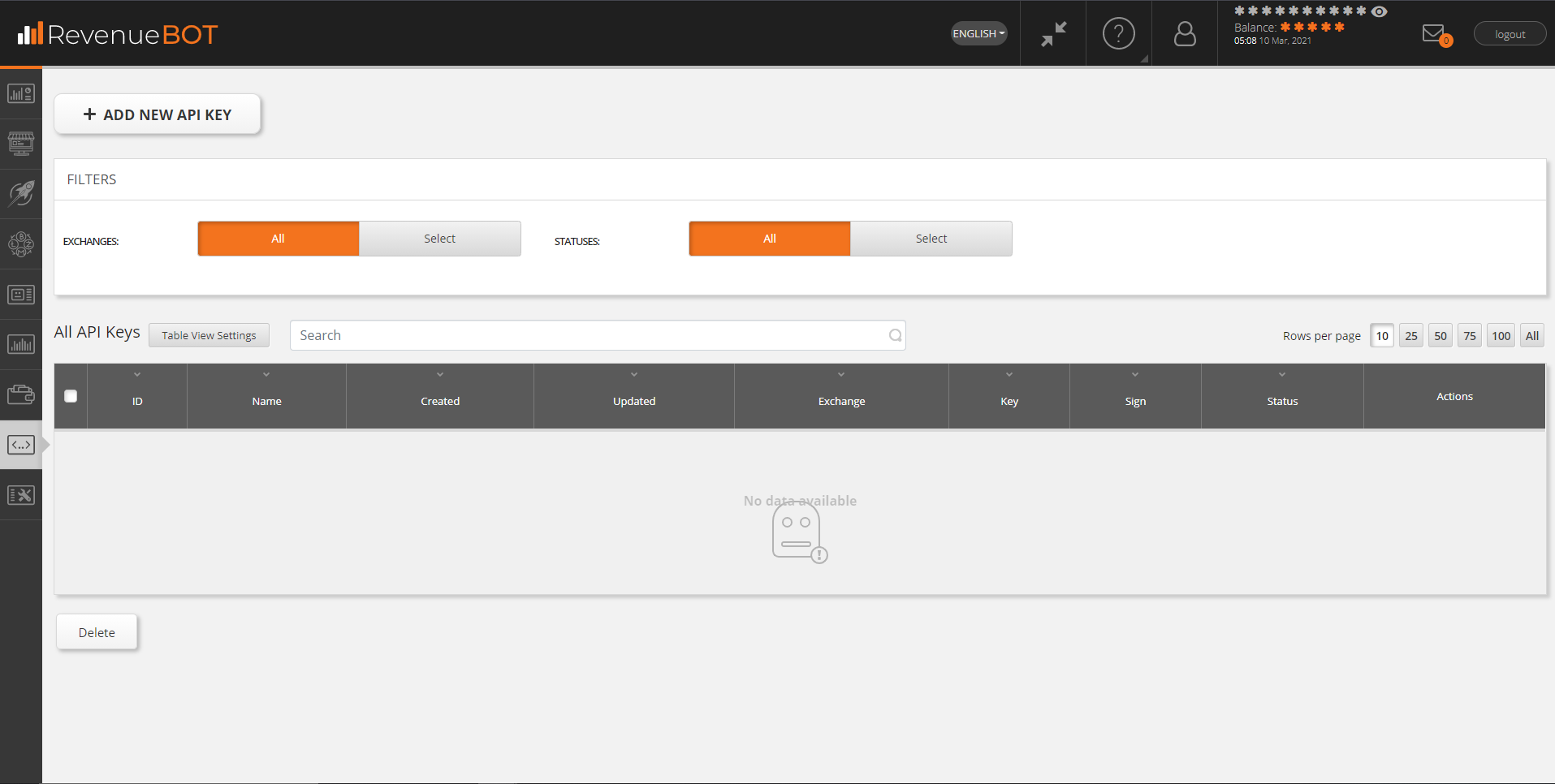

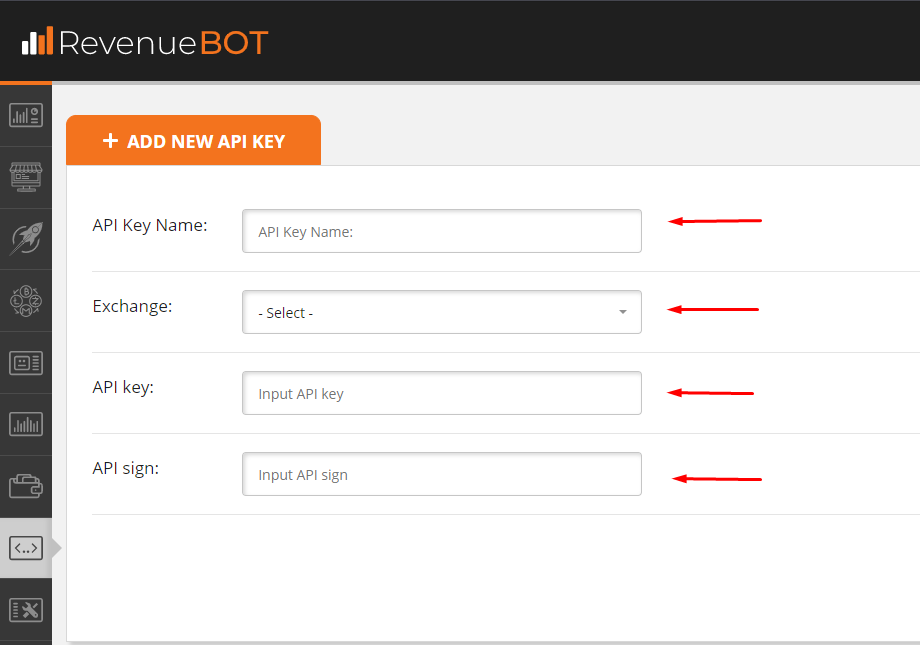

4. Adding an API key FTX.com in RevenueBot

Go to the RevenueBot personal account to add the FTX API key created on the exchange.

Click on «Add API key». You will see a form in which you need to fill in all the fields.

Attention! If you created an API key on the stock exchange using a sub-account, then the API Key field must be filled in the «apiKey/subaccountname» format, for example: «C1ZhRKLl0nnTiNjsq1no3Bb9OlSZ-jU6HKwGuLl6/subacc1»

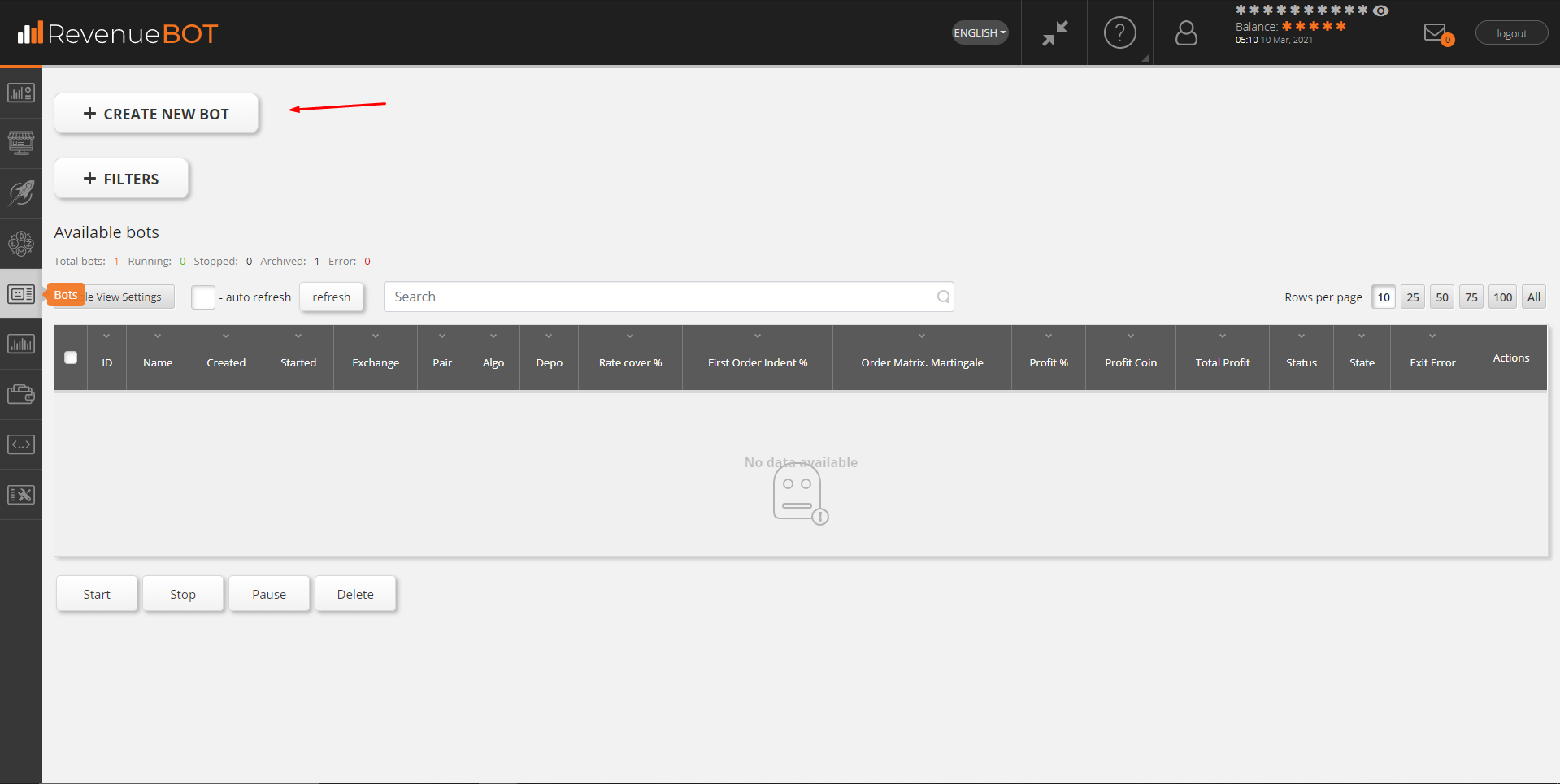

5. Creating a bot for FTX.com perpetual cryptocurrency futures

Go to the tab «Bots», in the personal account, and press «Create a new bot».

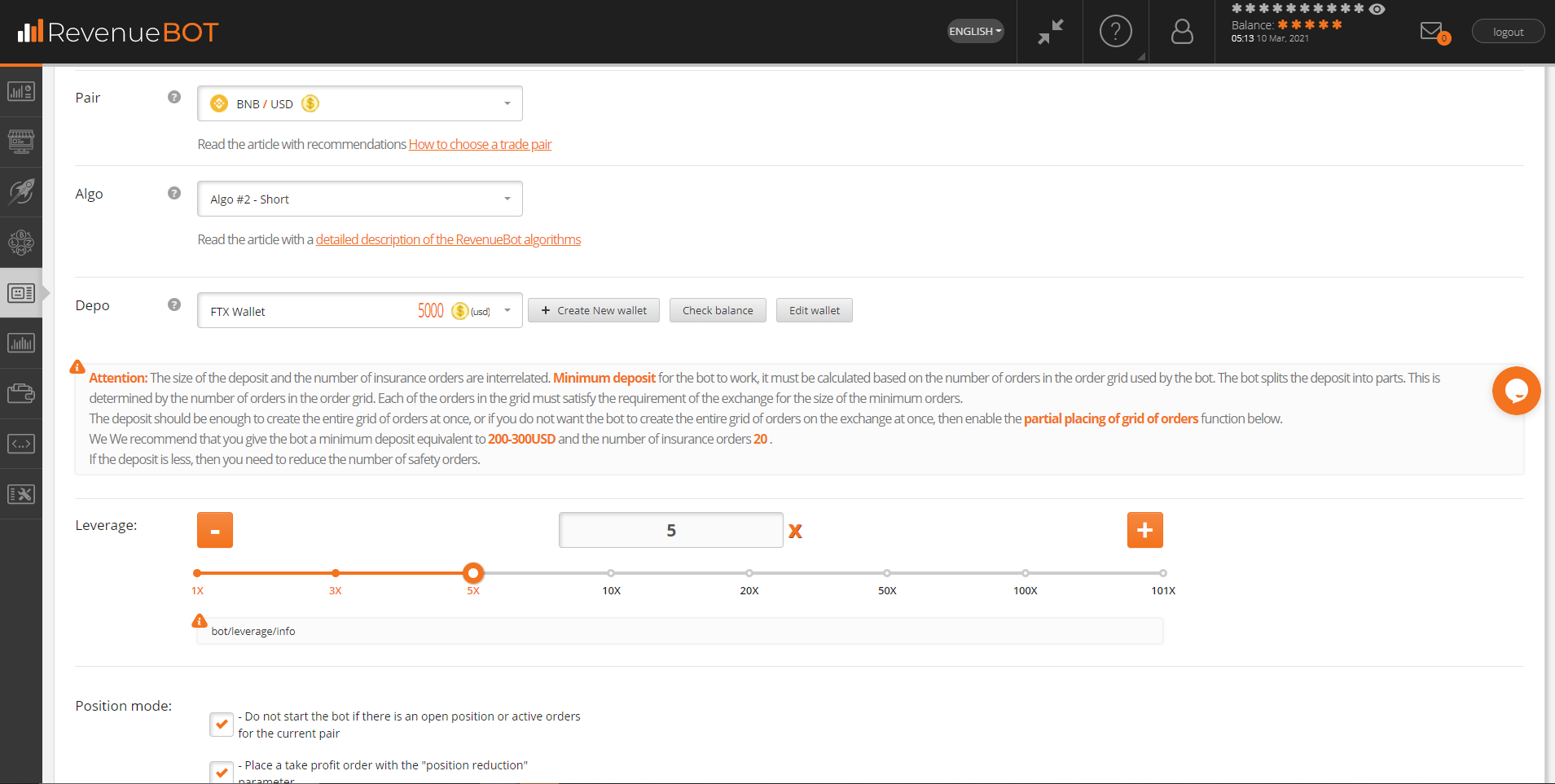

In order, we fill in all the fields that appear. After the exchange and API key are specified, you will see detailed bot settings. Initially, we choose the trading pair, the algorithm, the deposit and the amount of leverage. All settings provided are used solely for familiarization.

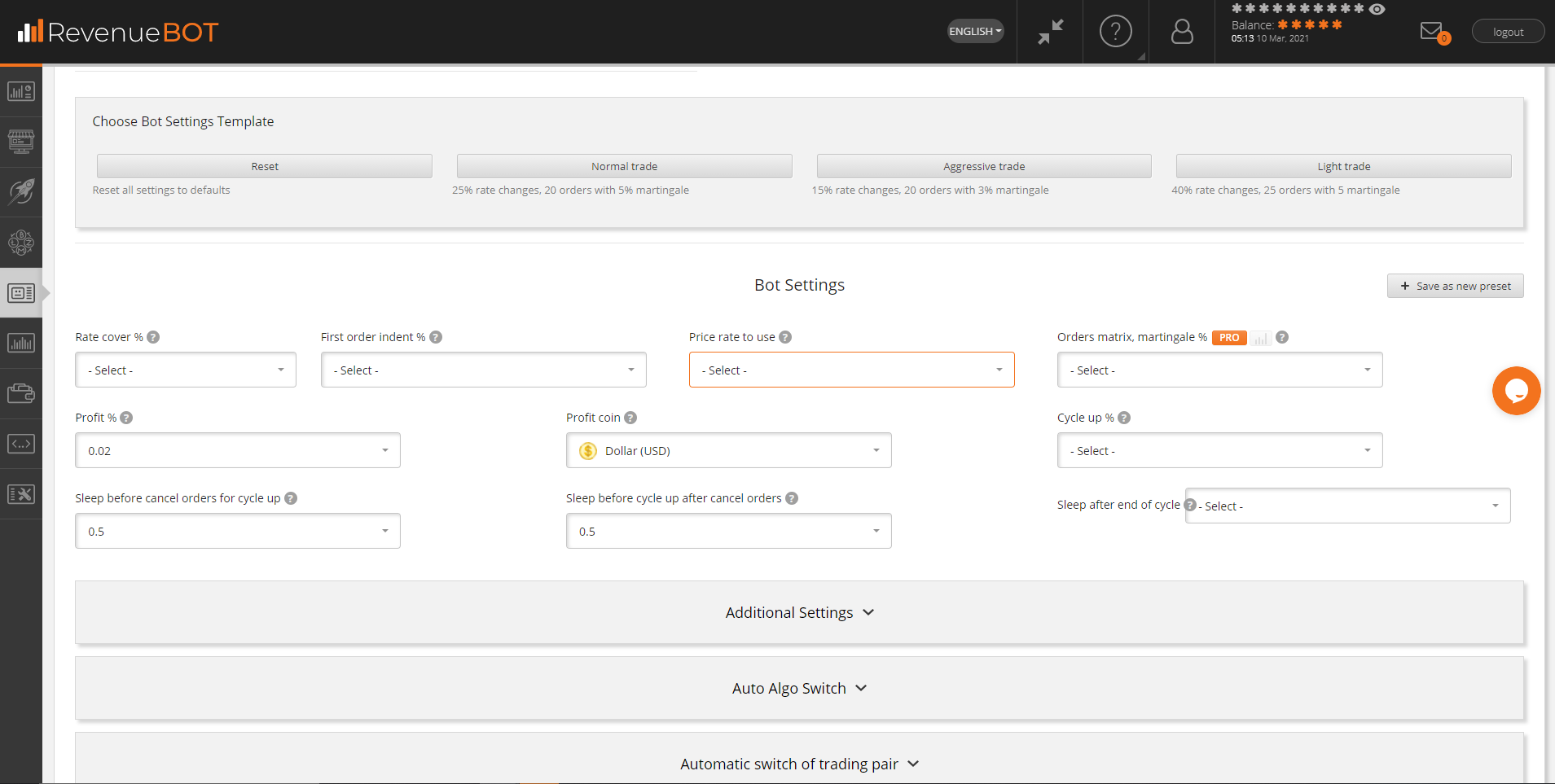

Scroll through next. Here you can choose ready templates for a bot or reset all settings to the original. After that, we will open a lot of settings, so I suggest we talk about each one in order:

- Overlapping the price change. This setting essentially specifies how much the bot will cover the possible price change in the trading pair with its insurance orders. This setting sets the limits within which the bot can avert. If the price changes more than specified in the Price Overlap setting, the bot will no longer be averaged because the last order of the safety net will be executed. We don’t recommend Price overlap below 30-40%

- Indent of the first order. Sets the percentage of the current price for the first order in the order grid. For example, BTC costs $50,000, you want the first order in the grid to open at $49,000. To do this, you need to set the margin of the first order to 2%.

- The price on the stock exchange. The price that will be used for the calculation in the order grid. The sales price is recommended using the LONG algorithm, the purchase price for the SHORT algorithm.

- The grid of orders, % of martingale. The number of orders in the grid depends on the deposit allocated to the bot. The deposit should be enough to create all the orders in the grid. We usually recommend a deposit of at least 200-300 USD and the number of orders is 15-20. The martingale sets how many percent the volume of each next grid order will be greater than the previous one. The larger the martingale, the smaller the price rebound will be needed for the take-profit order to be executed. The larger the martingale, the smaller the volume of the first orders of the grid will be, which reduces the profit, but reduces the risks. We usually recommend martingale at least 3-5%. With large deposits, you can increase martingale to 10%. By clicking on the PRO button, you can create your own grid of orders, which is not available in the presented options.

- Enable partial placement of the order grid. This setting allows you to set the number of simultaneously active orders that will be placed on the exchange from the entire grid of orders. As they are executed, the bot will issue new orders, so that simultaneously active on the exchange is exactly as specified in this setting.

- Enable cycle restructuring to be enabled. Using this mechanism, you can increase the value of the tuning «overlapping price change (%)» in the current active cycle of the bot. The new value will be applied when the specified number of orders of the safety net is executed on the exchange. Thus, you can move the prices of the remaining (new) insurance orders further away from the current exchange price when the price changes strongly and part of the bot’s insurance orders have already been executed.

- Profit. Take profit order, here you specify the percentage of profit at which the bot will complete the working cycle. Important: Exchange commission is not taken into account when issuing a take-profit order.

- The profit coin. This specifies the cryptocurrency in which the profit will be made. You can not set this up for futures trading, here the profit is always obtained in USD.

- Updating the order grid to the current price. The market is not static, so a price reversal in the wrong direction is common. To avoid waiting for the price to return to the right level, you can configure Updating the order grid to the current price which will update the grid to the current price. Note that this parameter must not be less than the Indent of the first order. This contributes to a large number of cancellations, which are discouraged by exchanges.

- Delay before canceling the order grid to update the order grid to the current price. Here you can set the time after which the current grid will be canceled and will rise to the current price on the exchange. This allows you to avoid false positives of updating the price of the order grid.

- Delay after canceling the order grid to update the price to the order grid. Specifies the time at which the new grid will be displayed. It happens that the price very quickly returns to its previous place, so the grid may be irrelevant.

- Delay after cycle completion. Specifies the time at which a new cycle will start after the old cycle has ended.

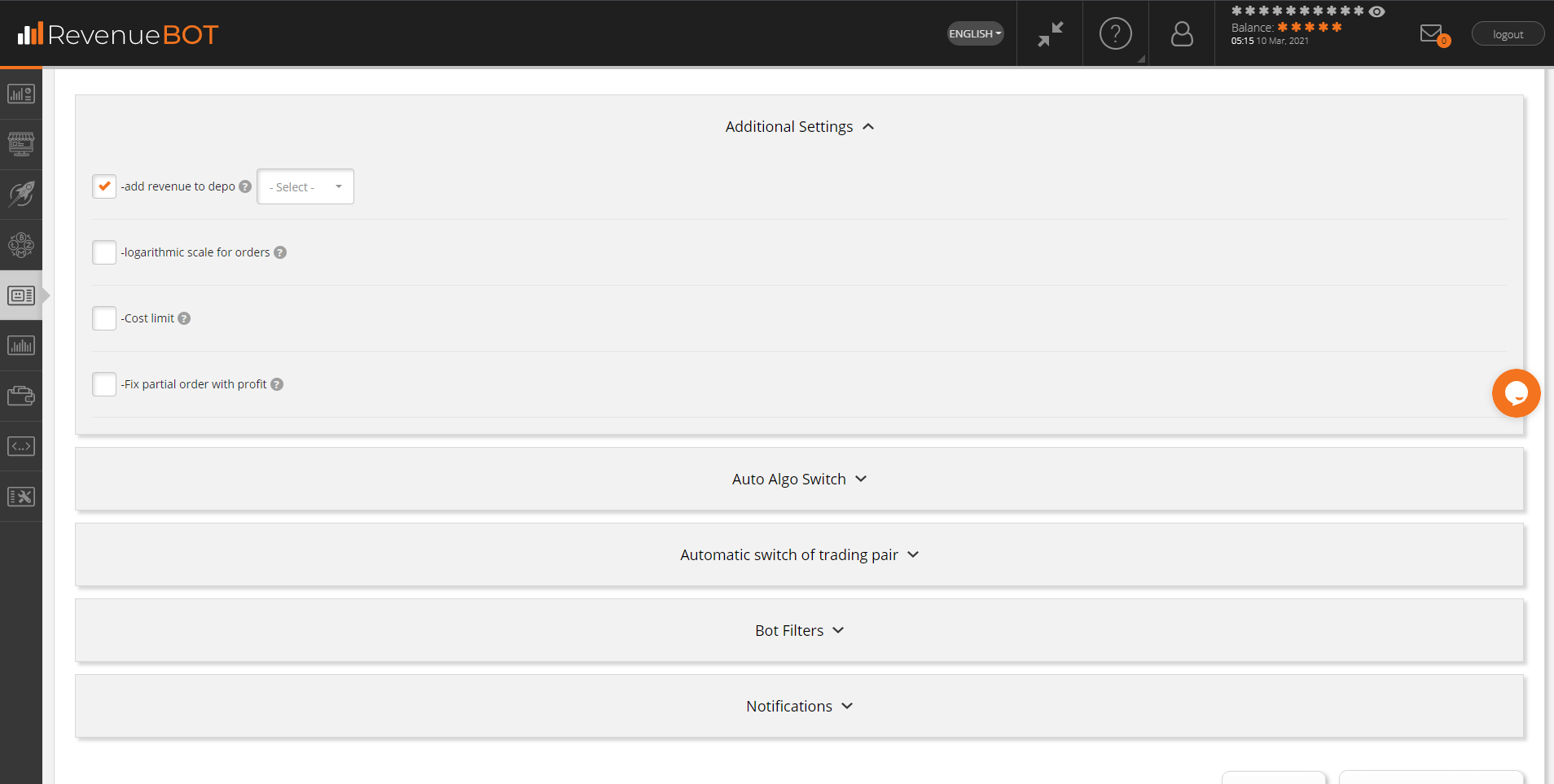

Next click on «Advanced Bot Settings». Here we see:

- Capitalization of Profit. The bot will add all profits or a specified percentage to its deposit, thereby increasing it.

- Logarithmic distribution of the price. When there is little volatility in the market, only the first grid orders will be executed, the rest will remain unfilled and will be canceled after the take is executed and the bot cycle is completed. To make use of more deposits in trade, you can use the Logarithmic Order Price Distribution. It adjusts the density of orders. The values of the logarithmic coefficient > 1 will increase the density of the orders near the current price (it involves more deposit in trade at low volatility, which will increase the profit but increase the risk). The values of the logarithmic coefficient < 1 will increase the density of the orders at a distance from the current price near the last grid order (we will greatly reduce the risks of trade, profit will also be smaller). Use the logarithmic price distribution to always check what the grid of orders is. By clicking Show the grid of orders, you can see the calculated prices and volumes of grid orders.

- Price limit. Set here the price level above which, under the LONG algorithm, the bot will not start a cycle. The SHORT algorithm must set a minimum price at which the bot does not start a cycle.

- Fix a partially executed order. By including this setting, you can set a percentage of profit to calculate the price at which we will get a profit if we cancel the partially executed order.

After filling all the above configurations click on «Create a new bot».

6. Features and recommendations for trading on the exchange FTX.com

- There is no position mode on the FTX exchange – hedging. If you want to implement risk hedging mechanisms, you can use sub-accounts that can be created in your account settings. Sub-accounts can be used to implement different trade strategies while avoiding the influence of open positions on each other.

- If you have the means (any other cryptocurrency) in your purse of the FTX Exchange other than the stablecoins that provide the USD basket, please note that if the margin/USD security is insufficient, these funds will be automatically exchanged on the spot market of the exchange at the current rate, to support the USD margin. These are the rules of the exchange. You can read more about margin/collateral here and here.

- To trade some trading pairs, you need to pass the KYC level 2 on the exchange. This applies, for example, to the XRP/USD pair.

- If you want to trade with a leverage of >20, you can only set this leverage if there are no active orders and / or open positions for any of the trading pairs. It’s an exchange rule. Therefore, if you intend to trade with a leverage of >20, using several bots for different trading pairs, then you need to manually assign the necessary leverage to all pairs on the exchange that you plan to trade. Otherwise, bots will not be able to set such leverage themselves.

- Initially, only $1,000 is available for withdrawal for the entire time. To increase the limit from $2,000 to $9,000 a day, you have to specify your real name and country of residence. To top up your account in fiat currencies, you need to go through the full verification procedure, with the provision of identity documents.

7. General recommendations for trading cryptocurrency futures using leverage

We usually recommend that you use no more than 20-30% of the funds that are on your futures purse. The remaining 70-80% will provide margin and allow open positions in plus, with extreme price changes in the wrong direction. The main purpose of trading should be to prevent liquidation (margin call).

We also recommend trading only coins from the TOP 20. coinmarketcap.com and we do not recommend using extreme leverage >20.

Overlap of the price change use at least 40%, use the cycle restructuring setting, which will increase the overlap of the price change to for example 60% with a strong price change, which will allow the bot to expand its averaging capabilities.