On September 15, we saw something that many in the crypto community have been waiting for – “The Merge” of Ethereum. The Merge transforms the Ethereum network from the energy-intensive Proof-of-Work consensus mechanism to a Proof-of-Stake one.

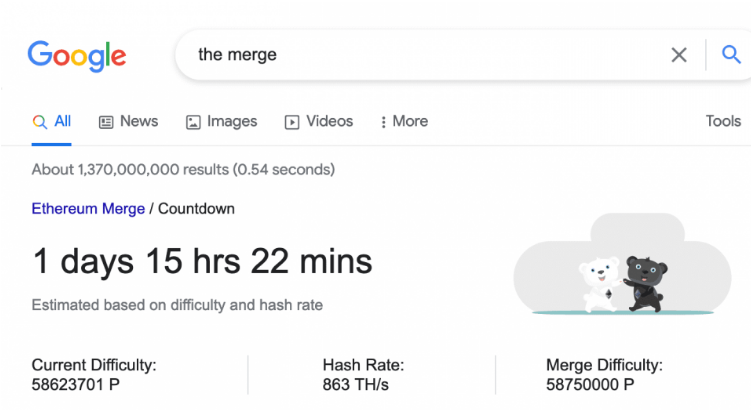

Google’s search engine marked the Merge, as well as the emergence of ETH2 by portraying two bears, with one white representing the consensus layer and the other being brown and black, merging into the Ethereum panda bear, a metaphor for Ethereum after the Merge. Before that, when you typed “The Merge” in the query, the search engine would give you a countdown:

However, even after the merger, Ethereum is still struggling from the ongoing crypto-winter, having lost nearly 17% last month. This is on par with the recent 16% drop in the price of the world’s preeminent cryptocurrency, a Bitcoin (BTC). ETH has lost about 58% since the beginning of the 2022.

You will find more in this article on what awaits the crypto community from the Merge and how it will affect the coin itself.

What is The Merge

Merge is a revised version of the Ethereum blockchain that uses a PoS consensus mechanism to confirm transactions using staking.

The Ethereum staking mechanism substitutes for the proof-of-work (PoW) model, where crypto miners use advanced computers to perform complex mathematical functions, known as hashes. The mining process requires an ever increasing amount of electricity to validate Ethereum transactions before they are recorded in the public blockchain.

Proof-of-Work consumes a tremendous amount of computing power. For example, Bitcoin mining currently consumes 127 terawatt hours (TWh) per year. That usage exceeds the entire annual electricity consumption of Norway.

With proof of work, Ethereum had an annual power consumption roughly equal to Finland, producing a carbon footprint similar to Switzerland. Post-merge, Ethereum is expected to reduce its carbon footprint by up to 99.95%, addressing one of the major criticisms of the cryptocurrency.

Ethereum vs. Ethereum 2.0: what’s the difference?

In December 2020, Ethereum began running on two parallel blockchains, a legacy one that operates using proof of work (Ethereum Mainnet) and a new chain for proof of stake (Beacon Chain). The merge combined Ethereum’s Mainnet and Beacon Chain into one unified blockchain operating on a proof of stake protocol.

The Ethereum Mainnet and Beacon Chain were originally referred to as ETH1 and ETH2, respectively. Their eventual merge was expected to be called Ethereum 2.0.

However, in January, the Ethereum Foundation asked users to start phasing out the term Ethereum 2.0. The Foundation decided that language no longer accurately represented their roadmap. They believed Ethereum 2.0 sounded too much like a different operating system, which is not at all what the merge is intended to implement.

With Ethereum 2.0 no longer in the official vocabulary, the Ethereum Foundation also asked users to refer to the Ethereum Mainnet as the “execution layer” rather than ETH1 and the Beacon Chain as the “consensus layer,” rather than ETH2. This terminology, they believe, better reflected their goals for the platform.

However, many crypto investors and enthusiasts still refer to post-merge Ethereum as Ethereum 2.0.

Ethereum Is moving from mining to staking

In 2008, Bitcoin introduced the world to the idea of a decentralized ledger – a single, immutable record of transactions that computers around the world could view, alter and trust without the need for intermediaries.

Ethereum, introduced in 2015, expanded upon the core concepts of Bitcoin with smart contracts – or computer programs that effectively use the blockchain as a global supercomputer, recording data onto its network. That innovation was the essential ingredient behind decentralized finance (DeFi) and NFTs – the main catalysts of the most recent crypto boom.

The Merge retires Ethereum’s proof-of-work system, where crypto miners competed to write transactions to its ledger – and earn rewards for doing so – by solving cryptographic puzzles.

Most crypto mining today happens in “farms,” though they may be more aptly described as factories. Picture massive warehouses lined with rows of computers stacked on top of one another like shelves of books at a university library – each computer hot to the touch as it strains to pump out cryptocurrency.

This system, which was pioneered by Bitcoin, is what caused Ethereum to guzzle so much energy and is responsible for fueling the blockchain sector’s reputation as an environmental menace.

Ethereum’s new system, proof-of-stake, does away with mining entirely.

Miners are replaced by validators – people who “stake” at least 32 ETH by sending them to an address on the Ethereum network where they cannot be bought or sold.

With the completion of Ethereum’s merge, the staking process replaces the mining one for verifying transactions.

Staking requires users to lock up a certain amount of cryptocurrency to participate in the transaction verification process. In a proof-of-stake model, an algorithm selects which validator gets to add the next block to a blockchain-based on how much cryptocurrency the validator has staked.

With Ethereum trading at nearly $1,400, the minimum requirement of 32 ETH is more than $40,000. Staking can be quite pricey for the average investor.

But individual investors can also join staking pools, which are collections of Ethereum stakers who combine their resources to start staking. In this way, they reduce the financial burden and share the income from ETH2 equally among themselves.

It is also possible to engage in trading, but barely anyone has the knowledge and experience to do so. So if you want to trade Ethereum on any exchange but are not sure how to do it, a cryptocurrency trading bot would help you. It works according to a pre-defined strategy and can earn passive profits for you when there is no time or knowledge to trade on your own.

The staking yield on Ethereum currently carries a 4% to 7% annual percentage rate (APR).

How the market responded to the Merge

As for the crypto market, traders and investors began to talk about The Merge more often in mid-summer. It was seen by them as a kind of spur to the rapid rise in the value of ETH. Etherium options have also started to bounce back after the launch of Ethereum 2.0. Such an event provided some kind of outlet for traders who were tired of the crypto market collapse.

Basically, this upgrade for Ethereum has been around for quite some time, as it has been included in the Ethereum roadmap since its inception. Chances are, therefore, that the market has already priced it in.

ETH exchange rate

At the time of writing, the exchange rate for Ethereum is $1,374.75, according to data from CoinGecko.

Here on the chart, you can see that the price of ETH remains flat.

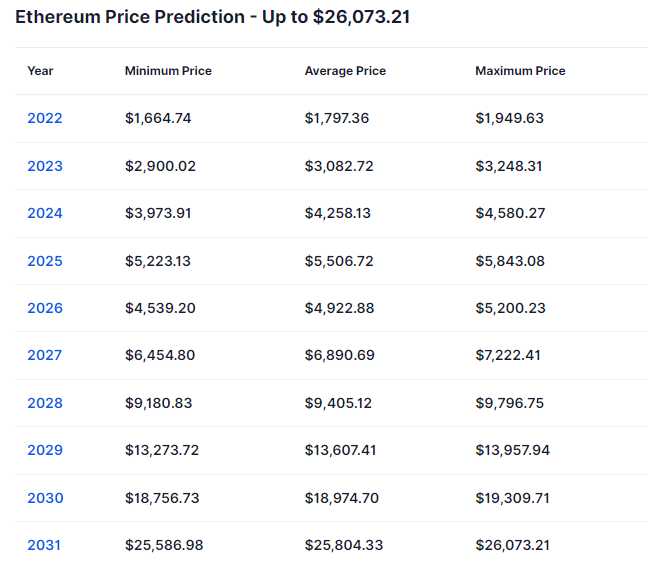

Based on the data from Digital Coin Price analytical service, the value of ETH will skyrocket and may reach $1,949 by the end of the year.

Ethereum vs. Bitcoin

Bitcoin and Ethereum are the two most popular cryptocurrencies, accounting for about 60% of global crypto market capitalization.

That’s even more than Bitcoin, which has gained more than 431% during the same period. Ethereum’s price has soared 453% in the past five years.

The merge makes Ethereum a more attractive investment than Bitcoin from an environmental, social and corporate governance (ESG) perspective, but it doesn’t necessarily make Ethereum a threat to dethrone Bitcoin as the world’s top crypto.

Chris Kline, chief operating officer and co-founder of Bitcoin IRA, says Bitcoin and Ethereum are more complementary than competitive within the crypto market.

“Bitcoin and Ethereum serve different purposes. Bitcoin is a proof-of-work, limited asset, monetary crypto, while Ethereum’s utility is a Web 3.0 backbone. Both serve as critical and distinct elements of the overall digital asset ecosystem underway,” Kline claims.

What Proof-of-Stake is

Decentralization lies at the very core of blockchain technology and cryptocurrencies. The blockchain has no central supervisor to control the recording of transactions and data. Instead, the network relies on an army of participants to validate incoming transactions and add them as new blocks on the chain.

Proof of stake is the consensus mechanism that helps choose which participants get to handle this lucrative task—lucrative because the chosen ones are rewarded with new crypto if they accurately validate the new data and don’t cheat the system.

“When blockchain participants verify that a transaction is legitimate and add it to the blockchain, we say that participants have achieved consensus,” says Marius Smith, head of business development at digital asset custodian Finoa.

With proof of stake, participants referred to as “validators” lock up set amounts of cryptocurrency or crypto tokens—their stake, as it were—in a smart contract on the blockchain. In return, they get a chance to validate new transactions and earn a reward. But if they improperly validate bad or fraudulent data, they may lose some or all of their stake as a penalty.

Solana, Terra and Cardano are among the biggest cryptocurrencies that use proof of stake. Now Ethereum is on a par with them.

Staking is when people agree to lock up an amount of cryptocurrency in exchange for the chance to validate new blocks of data to be added to a blockchain. These validators, or “stakers,” put their crypto into a smart contract that’s held on the blockchain.

The blockchain algorithm selects validators to check each new block of data based on how much crypto they’ve staked. The more you stake, the better your chance of being chosen to do the work. When the data that’s been cleared by the validator is added to the blockchain, they get newly minted crypto as a reward.

“The simple way to look at staking is like interest income that requires you to complete a task to earn the interest—checking blockchain transactions,” says Doug Schwenk, chief executive officer of Digital Asset Research. “If I validate only good transactions, I earn interest on my assets. If I include bad transactions, then I’ll be assessed penalties and lose some of my assets.”

If a validator submits bad data or fraudulent transactions, they could be punished by “slashing.” Their stake is “burned,” meaning it is sent to an unusable wallet address where nobody has access, rendering them useless forever.

According to Smith, proof of stake works because validators are saying “Hey, I have so much faith in the legitimacy of this transaction that I’m willing to back it up with my own money.” And verified transactions earn a cryptocurrency reward in proportion to the size of the stake.

Conclusion

The Merge and ETH2 are certainly important for both the Etherium Foundation itself as well as for the crypto community as a whole. One of the founders of Ethereum, Vitalik Buterin, commented “The Ethereum Merge is what we wanted to see initially. And this is just the first step to improving the ecosystem.” We have nothing to do but watch the further development of the world’ second most popular cryptocurrency in terms of market cap. However, if you want to start trading ETH right now, a cryptocurrency trading bot will come in handy. It will not only economize on time and effort, but it will also generate extra profits for you as a trader.