As early as Jan. 10, the U.S. Securities and Exchange Commission’s (SEC) approval of spot bitcoin ETFs on a number of leading exchanges was clearly a major achievement. With the original application being rejected back in 2013, this step marked the thrilling finale of a long-anticipated effort spanning over a decade. Top market players such as BlackRock, ARK Invest and Fidelity turned out to be among the ten issuers that were given permission to list a bitcoin ETF. From now on, investors can delve into the cryptoverse through familiar investment vehicles such as ETFs (exchange-traded funds).

Bitcoin ETFs, just like regular ones, offer you an opportunity to invest in BTC without having to hold the digital currency in physical form. What this does is pave the way for a wide range of investors seeking access to bitcoin’s potential profits but who are struggling to manage and secure their crypto wallets effeciently.

Physical Bitcoin ETFs

This one is an investment approach allowing investors to own bitcoins directly. Such type of ETF provides a straightforward way to access the global crypto market, eliminating the hassle of holding bitcoins by yourself.

However, you should consider a few factors when considering this very option. The cost of holding physical assets can be enormous and thus affect the overall return on your investment. What’s more, as opposed to the anonymity that self-owned cryptocurrency provides, investing in a such ETF could expose you to the threat of personal info leaks.

The expense ratios of physical bitcoin-ETFs may range from 0.24% to 1.5%, depending on the specific fund. These expenditures encompass various aspects of managing and storing the cryptocurrency, as well as the costs of administering the fund.

Spot Bitcoin ETFs

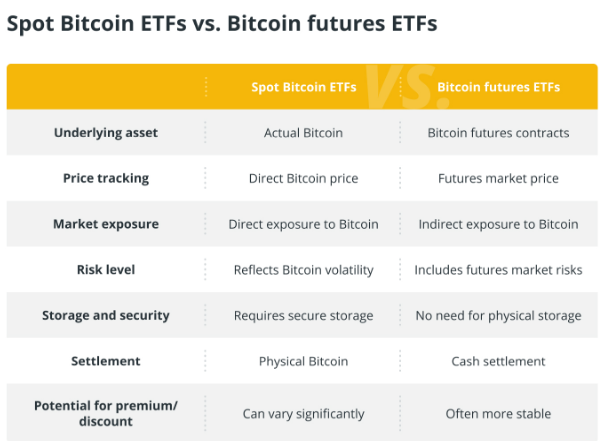

An investment fund that holds bitcoins for investors and pegs their value to the current market price of the cryptocurrency is called a spot Bitcoin ETFs.. This type of shares provides investors with a convenient avenue to gain exposure to the crypto space by allowing them to buy and sell shares of the fund based on real-time prices.

Still, as is the case with any investment vehicle, here investors face a wide array of risks. The crypto market volatility contributes directly to the value of ETFs, so investors may experience substantial price swings. They are required to adopt a strategic approach and be in tune with the rapid market developments.

Additionally, these investors might incur brokerage commissions and management fees. Such expenses may undermine the total return and require a thorough analysis on the part of the investor.

Futures-based Bitcoin ETFs

Bitcoin futures ETF or derivatives-based Bitcoin ETFs draw their value from Bitcoin futures contracts rather than through the holding of the asset. This approach empowers investors with access to the crypto market while mitigating the risks associated with direct ownership of BTC.

Futures ETFs typically track buy-and-sell agreements, monitoring price movements. Such shares provide an avenue for exposure, so they are subject to market volatility associated with futures trading, such as backwardation [the market condition wherein the price of a futures contract is trading below the expected spot price] and contango [a situation where the futures price of a commodity is higher than the spot price].

Understanding the risks related to futures contracts is pivotal for investors considering this type of Bitcoin ETF. Also, investors should be prepared for potential market fluctuations and realize that ETF returns may be affected by factors affecting bitcoin futures prices.

What exactly to consider before investing in Bitcoin ETFs?

Investing in Bitcoin ETFs requires careful consideration of ETF investment strategies and various factors aligned with individual financial goals and risk tolerance. Understanding the different Bitcoin ETF structures and ETF investment opportunities is essential for making an informed decision and selecting the right Bitcoin ETF.

Investment goals

Whether seeking long-term growth, short-term yield or hedging against market wavering, diverse Bitcoin ETF offerings meet specific goals. Say, for investors looking for direct exposure to Bitcoin’s value, physical Bitcoin ETFs might suit their goals.

Market insight

A profound understanding of the crypto market is imperative. Discovering different options involves a comparison of Bitcoin ETF varieties like physical, spot, futures-based and various other structures listed earlier.

You should habituate to the subtleties of each type, recognizing the impact of market conditions on the desired ETF. Keeping track of regulatory developments, technological advancements and general market trends leads to a proper understanding.

Conclusion

Bitcoin ETFs introduce an trail-blazing way for investors to access the crypto market through familiar investment instruments. Ranging from physical bitcoin ETFs that grant direct access to real crypto assets all the way to futures-based ETFs enabling you to invest via derivatives, the spectrum of vehicles available allows investors to choose the best fit.

Nevertheless, before making an ultimate decision whether to invest in a bitcoin ETF, it is vital to DYOR (Do Your Own Reseach) of each type of ETF, evaluate their benefits and risks, as well as take into account your own investment objectives. Once you fully grasp the features of each type mentioned, it will help you make the right decisions and ensure that you achieve the desired financial performance.